Password protected

To comply with NDAs and confidentiality agreements, a password is required to view my previous work.

Email alisha.oni@googlemail.com if you're struggling to access.

Designing a mobile-first onboarding experience

Objective

To uplift the onboarding experience, delivering a streamlined digital experience that's personalised and affirms confidence of prospects who've committed to becoming a client of the private bank.

Objective

To uplift the onboarding experience, delivering a streamlined digital experience that's personalised and affirms confidence of prospects who've committed to becoming a client of the private bank.

Objective

To uplift the onboarding experience, delivering a streamlined digital experience that's personalised and affirms confidence of prospects who've committed to becoming a client of the private bank.

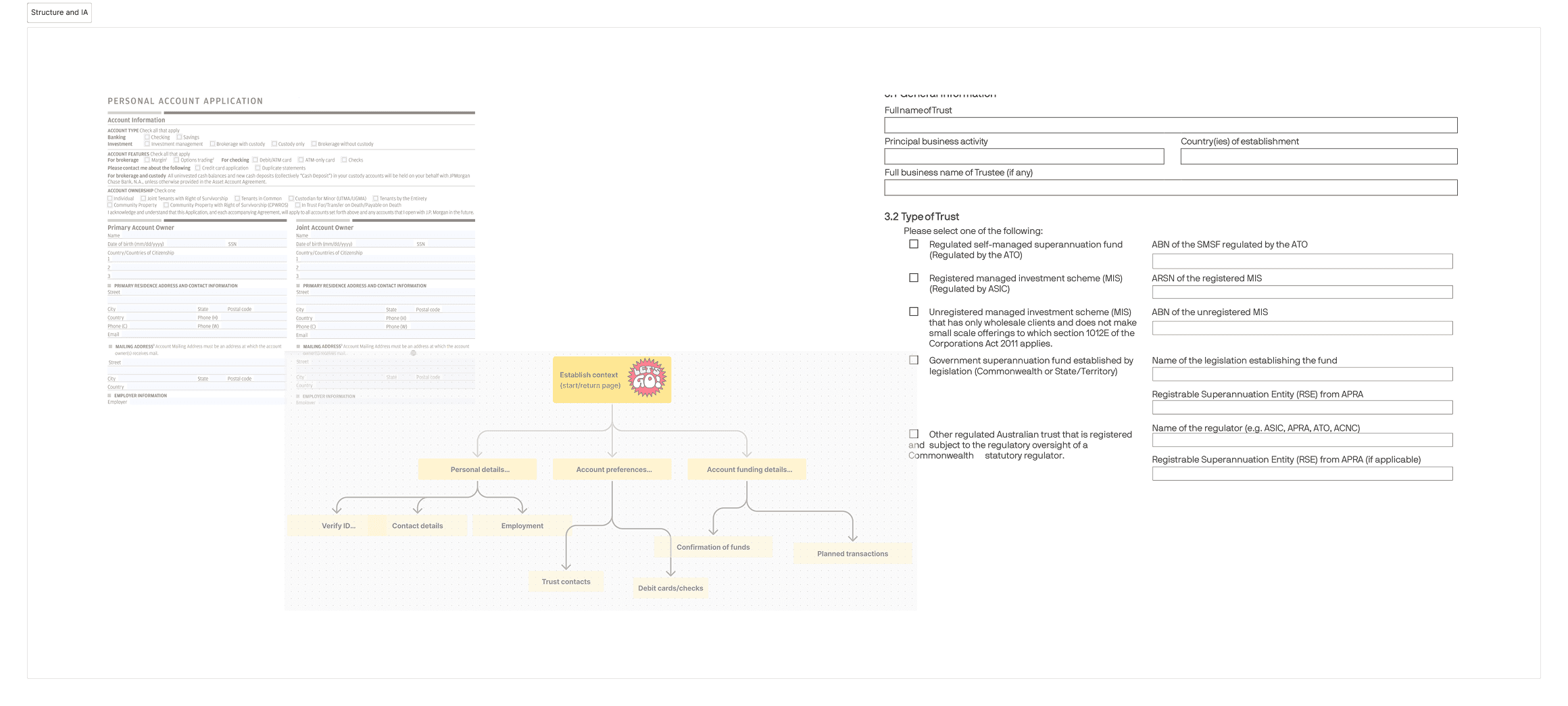

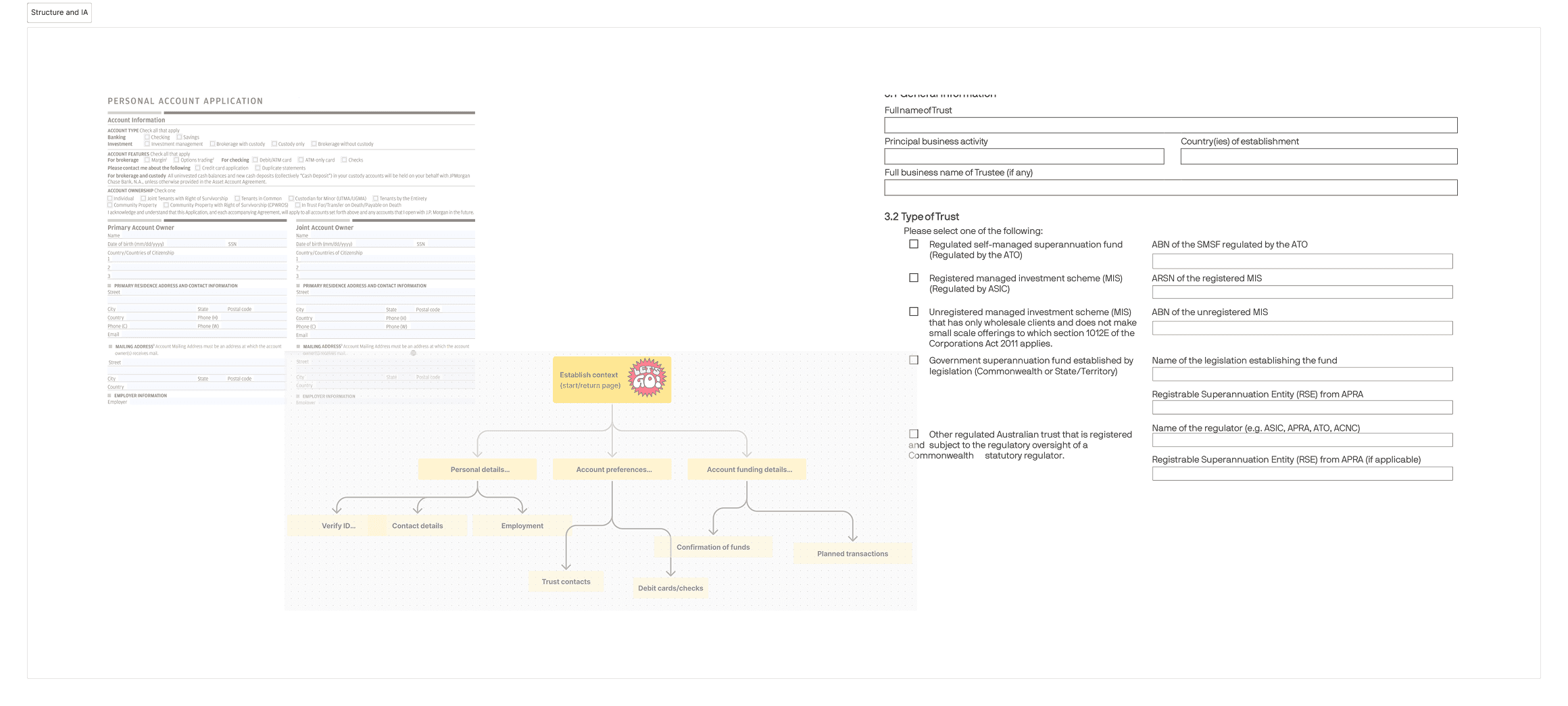

The current onboarding process for opening a private bank account is cumbersome, repetitive and most-significantly largely offline.

Context

Private bankers build relationships with high and ultra-high-net-worth individuals in premium, offline settings such as exclusive events. However, the experience of onboarding as a private banking client shifts the moment a prospect decides to become a client.

Ideally, the transition to becoming a client should be seamless. However, alongside asking prospects to complete lengthy paper forms, provide the same information (repeatedly) and weeks of back-and-forth to satisfy KYC and AML requirements, the onboarding experience is finalised with bankers asking prospects (many of whom are already digitally savvy) to print, sign, scan and email documents, with inconsistent or non-existent information on why or how their information will be handled.

Onboarding as a private bank client 2 weeks on average, with identity and source of wealth verification alone requiring 3-5 days (and even longer for complex cases). Up to 80% of prospects drop-off and don't complete the process. c

Meanwhile, bankers faced an impossible task of maintaining engagement with prospects and keeping them "warm" with limited official tools to help. The promise of a high-touch, personalised private banking experience that'd convinced some prospects to join disappeared the moment.

Objective

To uplift the onboarding experience, delivering a streamlined digital experience that's personalised and affirms confidence of prospects who've committed to becoming a client of the private bank.

My role and approach

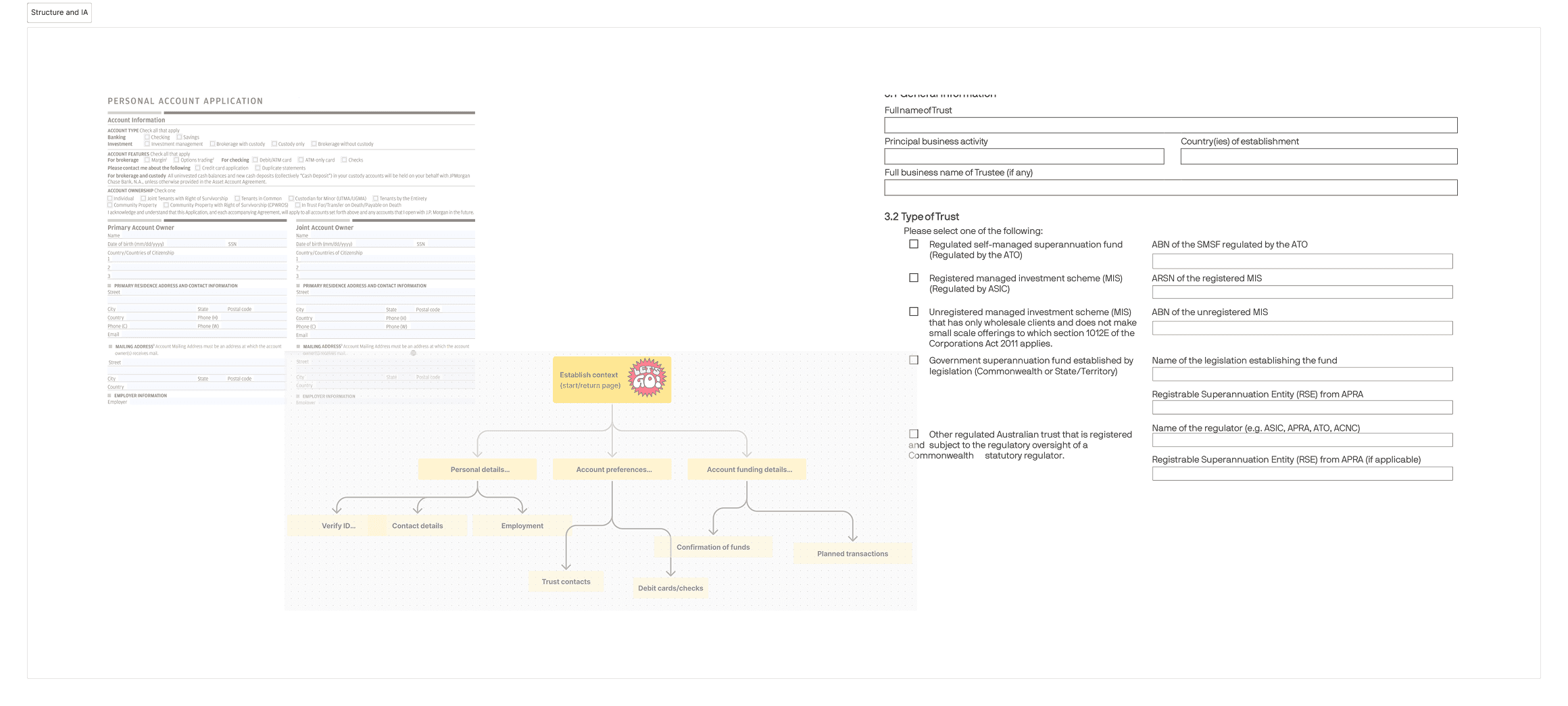

Discovery and audit

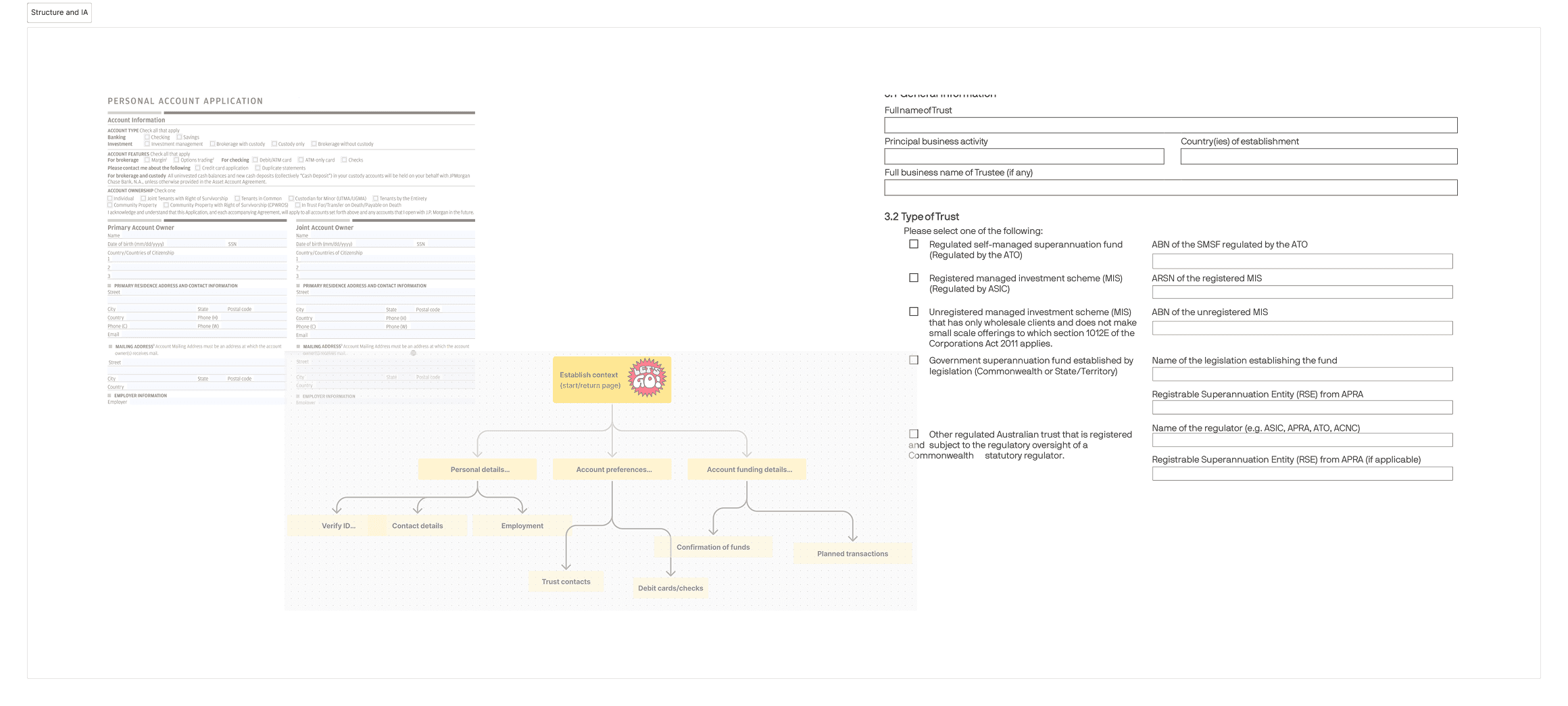

Through user research and feedback from recently onboarded clients and advisors, we identified that the current onboarding experience created 3 fundamental problems:

Cognitive overload, particularly for clients new to wealth management

Inefficient and insecure back-and-forth with advisors

Document sharing processes insecure and incompatible within a mobile-first world

Product, content and experience strategy

These findings shaped our priorities, which translated into 3 grounding pillars of the product, content and experience strategy:

Reduce cognitive load

Building and affirming trust

Enable seamless advisor connection

Reduce cognitive load

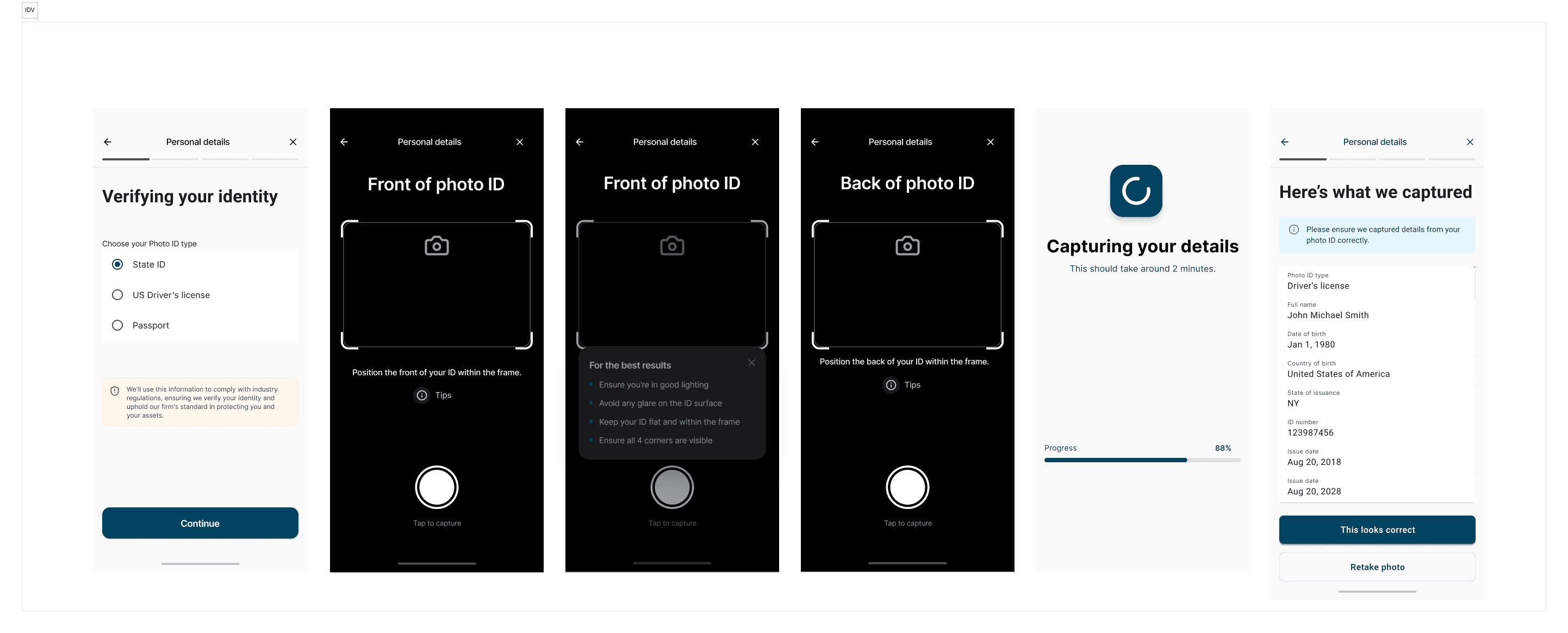

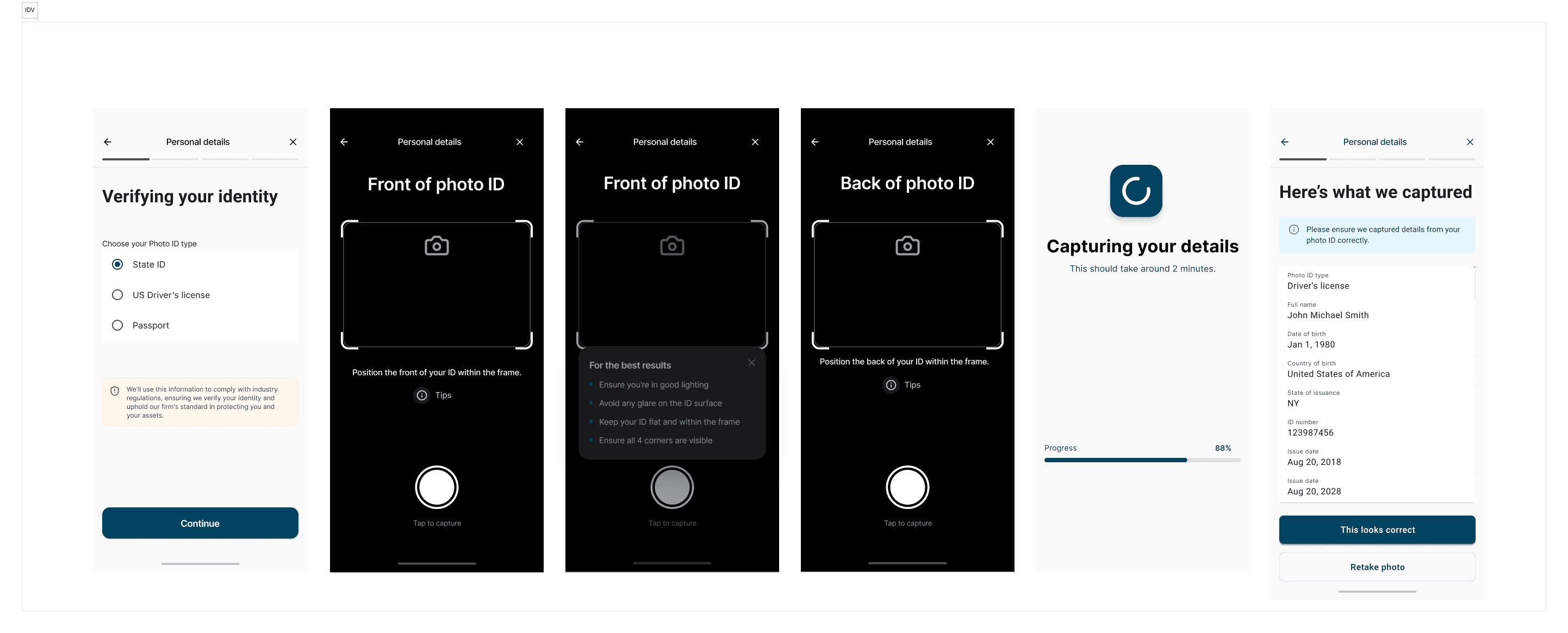

Where possible, we prioritised opportunities where we could leverage technology to "do the heavy lifting" of completing several forms, ultimately saving time, for both the bank and the prospect.

This included designing intuitive interactions that could be completed almost anywhere. for example, we designed several contextual pre-filling interactions extracting data from reliable sources such as a valid photo ID, proof of residence and details shared by other account owners (new).

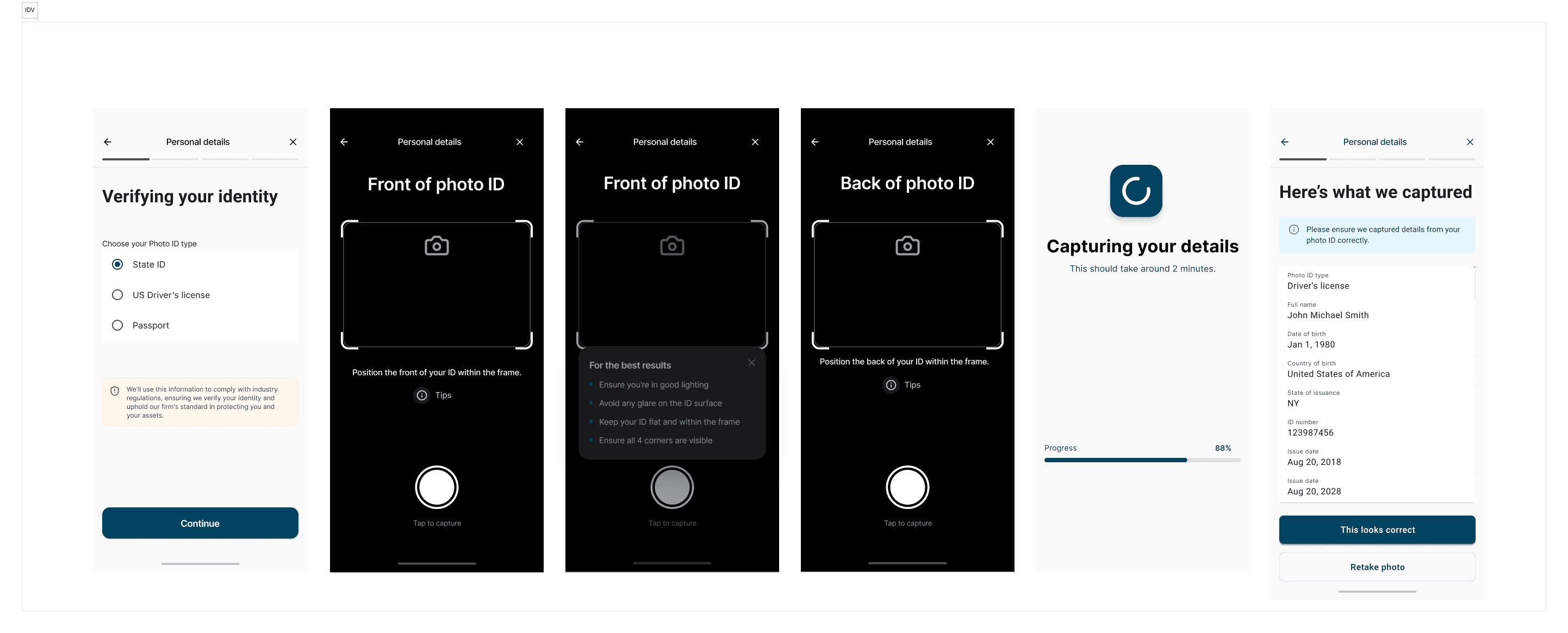

Identity verification is inherently stressful - clients are being asked to photograph sensitive documents on their personal devices. We designed this experience to feel guided and secure rather than overwhelming, including:

Clear choice architecture: 3 photo ID options presented upfront with radio buttons

One action per screen: Each step focused on a single task, as opposed to rather than multi-step forms

Proactive guidance: Real-time tips appeared contextually, limiting the need for prospects to send screenshots to their advisors for help

Transparent processing: The loading state showed exactly what was happening with a progress indicator, reducing anxiety during the wait

Built-in error recovery: "This looks correct" confirmation with option to "Retake photo"

To finalise this content approach, I worked closely with our legal team to ensure our intuitive approach remained compliant with our KYC requirements.

Form field reduction: 15 (offline) - > 4 confirmation steps.

Building and affirming trust in prospects

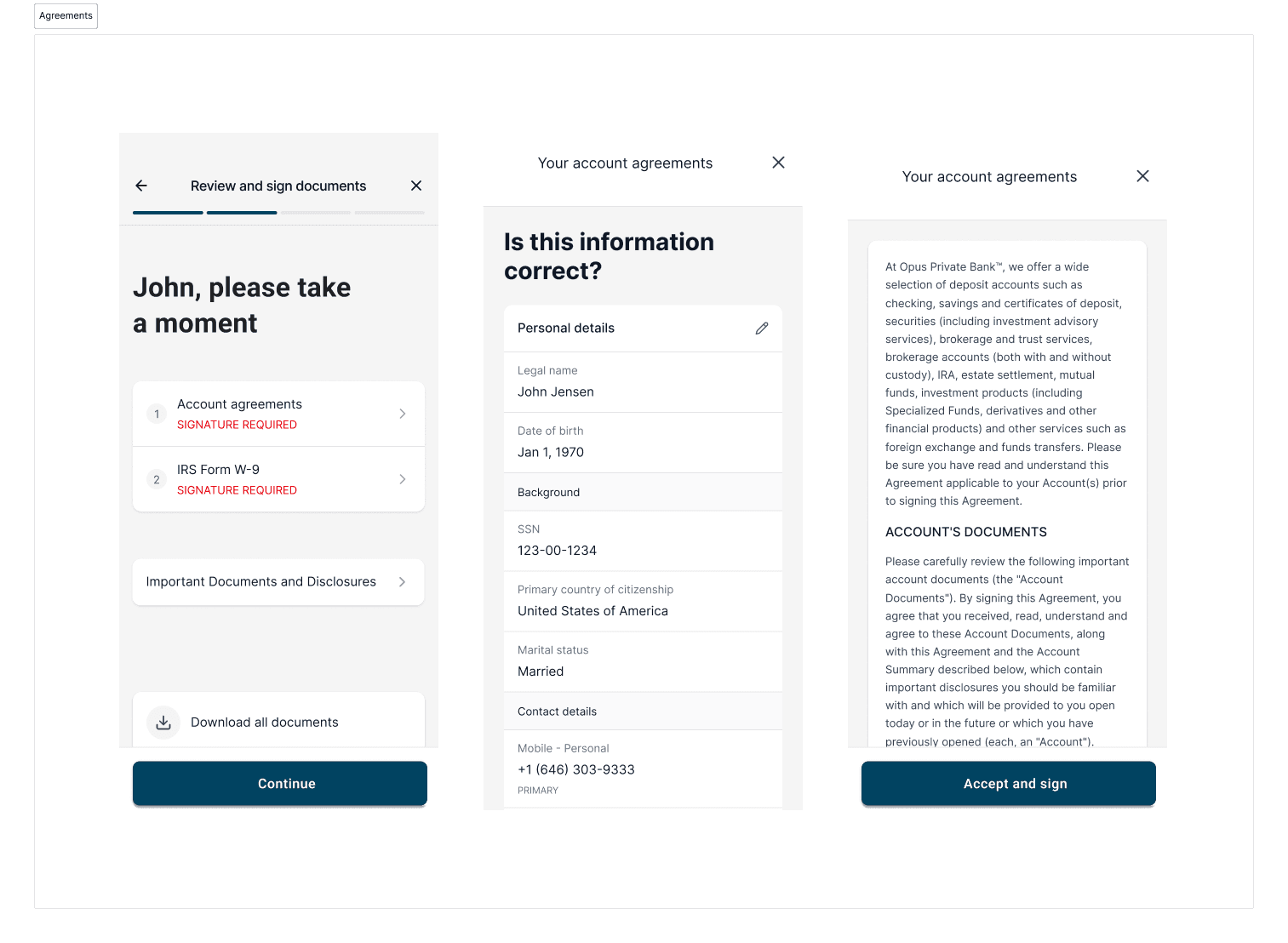

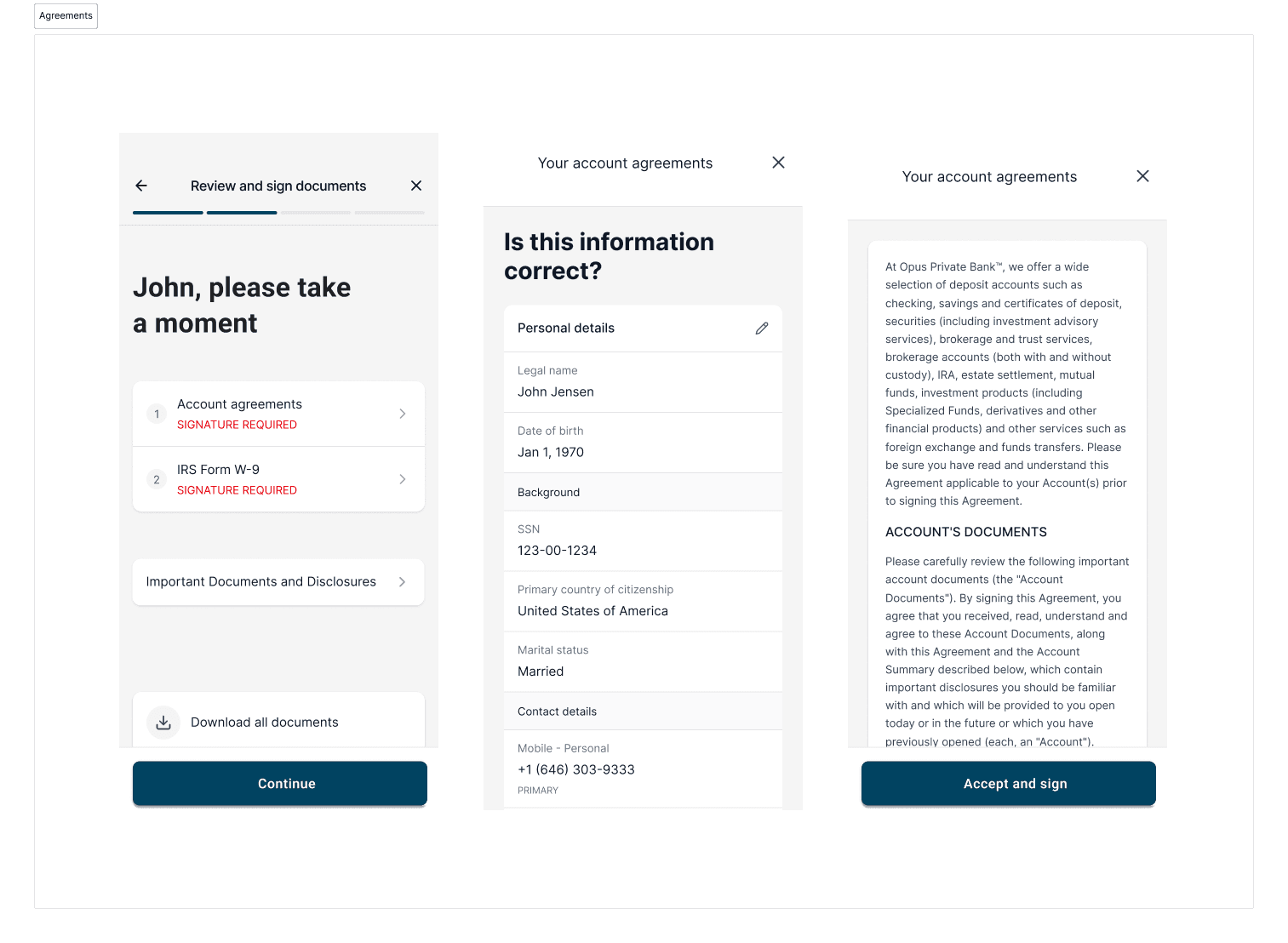

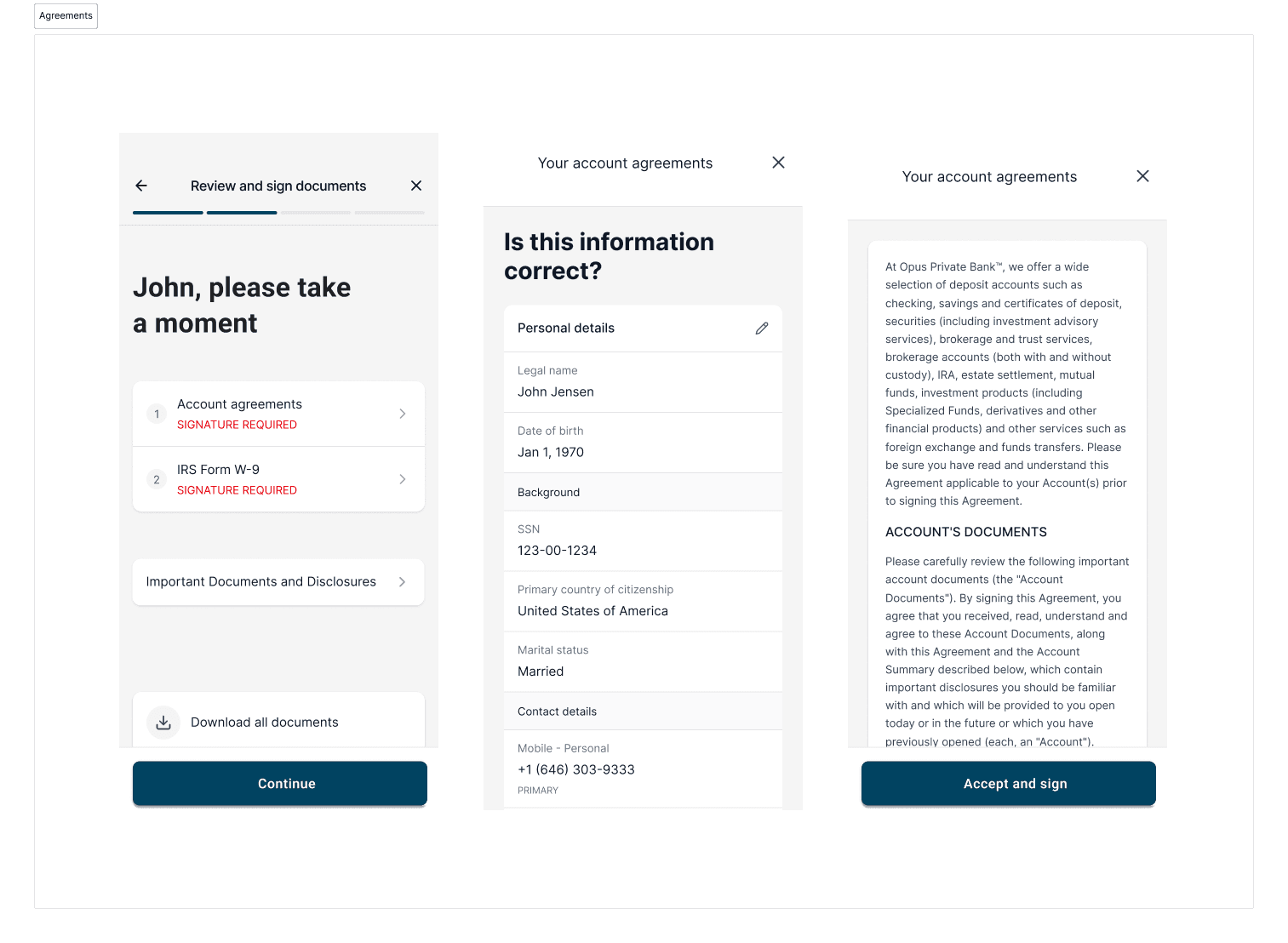

To maintain trust with prospects unfamiliar with wealth management processes, we transformed overwhelming legal documentation into a guided, transparent experience. We designed a progressive flow that:

Confirmed pre-filled information first ("Is this information correct?") - reducing cognitive load and building confidence through accuracy

Explained what they were signing in plain language before presenting documents - "Your account agreements" instead of document reference numbers

Showed transparent previews of dense legal text alongside conversational explanations

Created clear signing touch points with "SIGNATURE REQUIRED" labels that set expectations

Mirrored the concierge style product dialogue with personalised pacing: "John, please take a moment" - addressing the client by name and acknowledging thei important decisions require pause.

This approach maintained full regulatory compliance while reducing the intimidation factor of legal processes. Clients could see exactly what they were agreeing to, when they'd need to take action, and why each step mattered."

We also applied progressive disclosure and confirmation bias principles - showing clients we already knew them (pre-filled data) before asking them to trust us with their wealth (signing agreements). This sequence reduced anxiety and built confidence.

Enabling seamless advisor connection

We continued mirroring the concierge, dialogue between the product and prospects by:

Implementing human touch points within automation: Clearly signposting when advisor involvement is needed while allowing clients to progress independently on straightforward steps

Confirmation over interrogation: Pre-filling verified data where possible, asking "Is this information correct?" rather than requiring clients to re-enter information they'd already shared with their advisor

So far, this approach has reduced back-and-forth between advisors and clients by 40%.

Outcomes

Currently, we're running a pilot MVP. Based on previous usability testing, success metrics include:

Task completion rate - > 95% (on target)

Completion in 1 session - > 85% (on target

Time to complete - < 30 minutes (currently averaging around 6 minutes)

Comprehension accuracy - > 95% (on target - no in-app request for banker support)

STP (straight through processing) and response accuracy - 90% (on target, however also dependent on internal systems)

Alongside this, 100% of our regulatory disclosures have been marked as compliant, recording 0 identified violations (only recommendations).

The current onboarding process for opening a private bank account is cumbersome, repetitive and most-significantly largely offline.

Context

Private bankers build relationships with high and ultra-high-net-worth individuals in premium, offline settings such as exclusive events. However, the experience of onboarding as a private banking client shifts the moment a prospect decides to become a client.

Ideally, the transition to becoming a client should be seamless. However, alongside asking prospects to complete lengthy paper forms, provide the same information (repeatedly) and weeks of back-and-forth to satisfy KYC and AML requirements, the onboarding experience is finalised with bankers asking prospects (many of whom are already digitally savvy) to print, sign, scan and email documents, with inconsistent or non-existent information on why or how their information will be handled.

Onboarding as a private bank client 2 weeks on average, with identity and source of wealth verification alone requiring 3-5 days (and even longer for complex cases). Up to 80% of prospects drop-off and don't complete the process. c

Meanwhile, bankers faced an impossible task of maintaining engagement with prospects and keeping them "warm" with limited official tools to help. The promise of a high-touch, personalised private banking experience that'd convinced some prospects to join disappeared the moment.

Objective

To uplift the onboarding experience, delivering a streamlined digital experience that's personalised and affirms confidence of prospects who've committed to becoming a client of the private bank.

My role and approach

Discovery and audit

Through user research and feedback from recently onboarded clients and advisors, we identified that the current onboarding experience created 3 fundamental problems:

Cognitive overload, particularly for clients new to wealth management

Inefficient and insecure back-and-forth with advisors

Document sharing processes insecure and incompatible within a mobile-first world

Product, content and experience strategy

These findings shaped our priorities, which translated into 3 grounding pillars of the product, content and experience strategy:

Reduce cognitive load

Building and affirming trust

Enable seamless advisor connection

Reduce cognitive load

Where possible, we prioritised opportunities where we could leverage technology to "do the heavy lifting" of completing several forms, ultimately saving time, for both the bank and the prospect.

This included designing intuitive interactions that could be completed almost anywhere. for example, we designed several contextual pre-filling interactions extracting data from reliable sources such as a valid photo ID, proof of residence and details shared by other account owners (new).

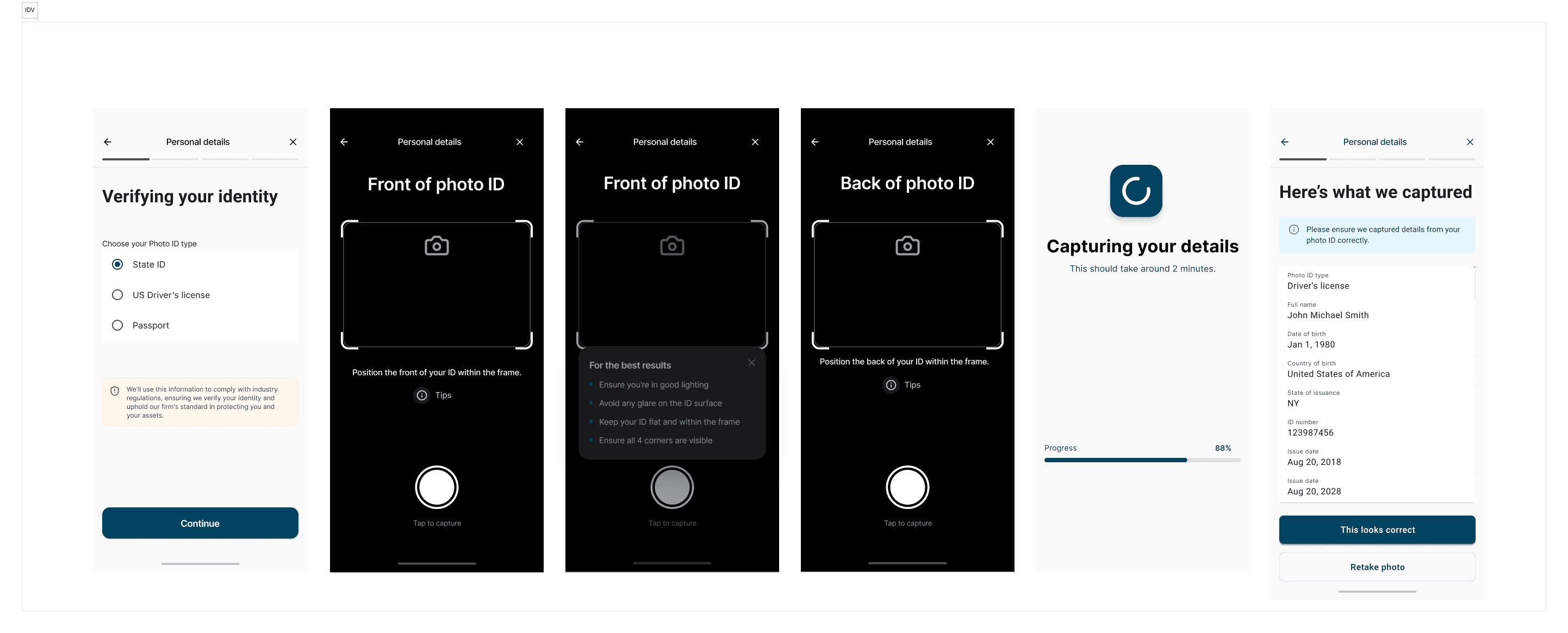

Identity verification is inherently stressful - clients are being asked to photograph sensitive documents on their personal devices. We designed this experience to feel guided and secure rather than overwhelming, including:

Clear choice architecture: 3 photo ID options presented upfront with radio buttons

One action per screen: Each step focused on a single task, as opposed to rather than multi-step forms

Proactive guidance: Real-time tips appeared contextually, limiting the need for prospects to send screenshots to their advisors for help

Transparent processing: The loading state showed exactly what was happening with a progress indicator, reducing anxiety during the wait

Built-in error recovery: "This looks correct" confirmation with option to "Retake photo"

To finalise this content approach, I worked closely with our legal team to ensure our intuitive approach remained compliant with our KYC requirements.

Form field reduction: 15 (offline) - > 4 confirmation steps.

Building and affirming trust in prospects

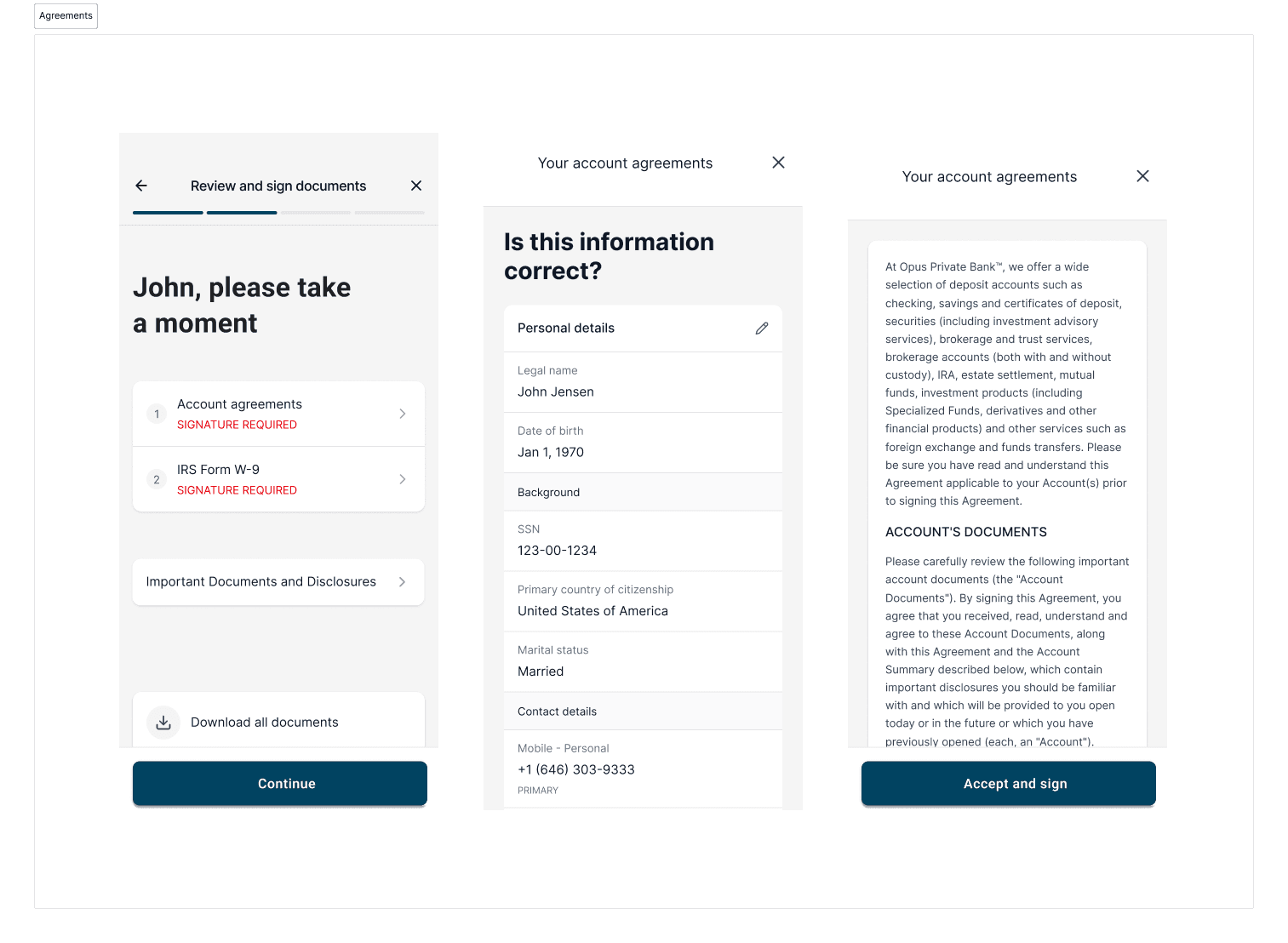

To maintain trust with prospects unfamiliar with wealth management processes, we transformed overwhelming legal documentation into a guided, transparent experience. We designed a progressive flow that:

Confirmed pre-filled information first ("Is this information correct?") - reducing cognitive load and building confidence through accuracy

Explained what they were signing in plain language before presenting documents - "Your account agreements" instead of document reference numbers

Showed transparent previews of dense legal text alongside conversational explanations

Created clear signing touch points with "SIGNATURE REQUIRED" labels that set expectations

Mirrored the concierge style product dialogue with personalised pacing: "John, please take a moment" - addressing the client by name and acknowledging thei important decisions require pause.

This approach maintained full regulatory compliance while reducing the intimidation factor of legal processes. Clients could see exactly what they were agreeing to, when they'd need to take action, and why each step mattered."

We also applied progressive disclosure and confirmation bias principles - showing clients we already knew them (pre-filled data) before asking them to trust us with their wealth (signing agreements). This sequence reduced anxiety and built confidence.

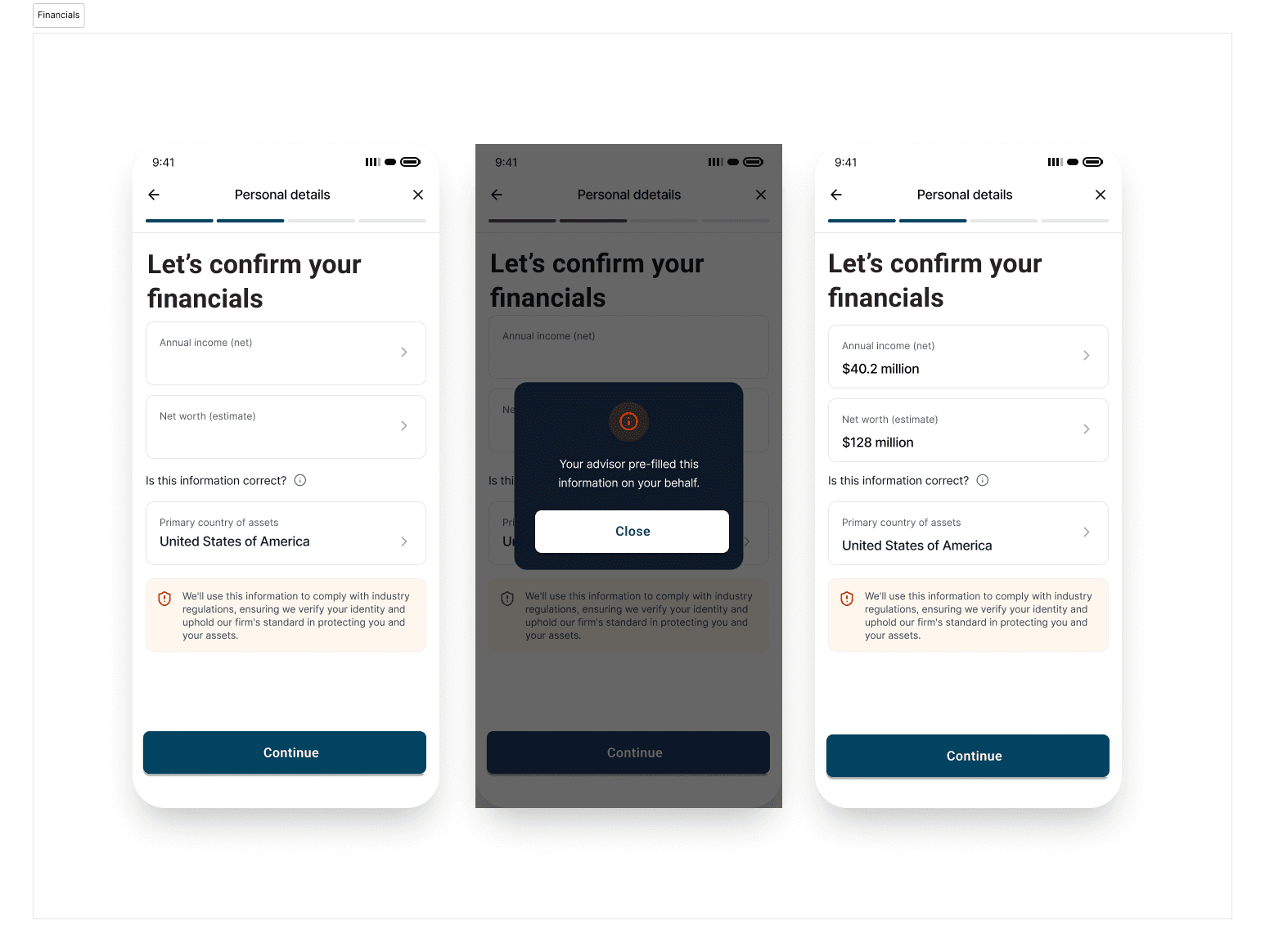

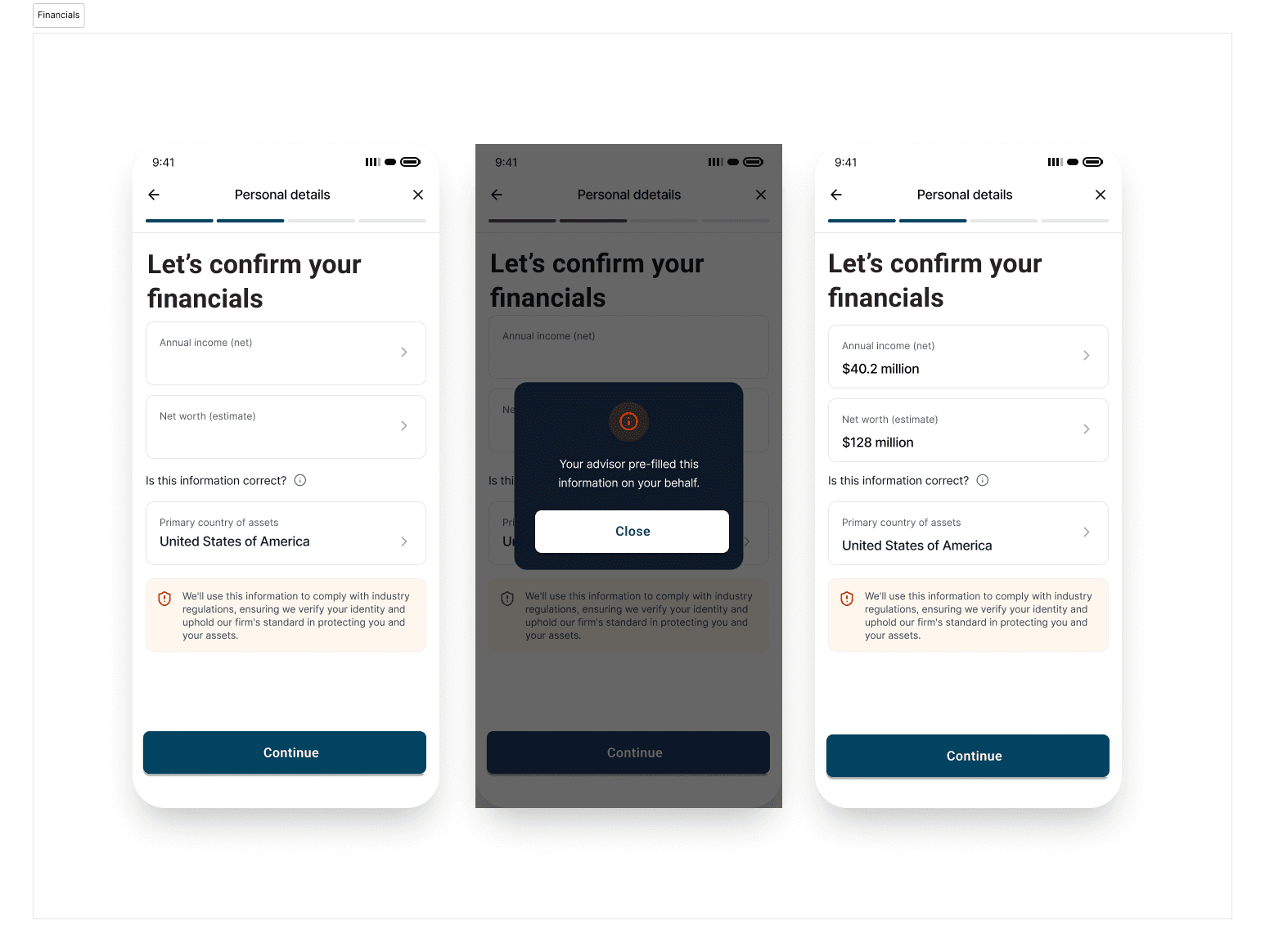

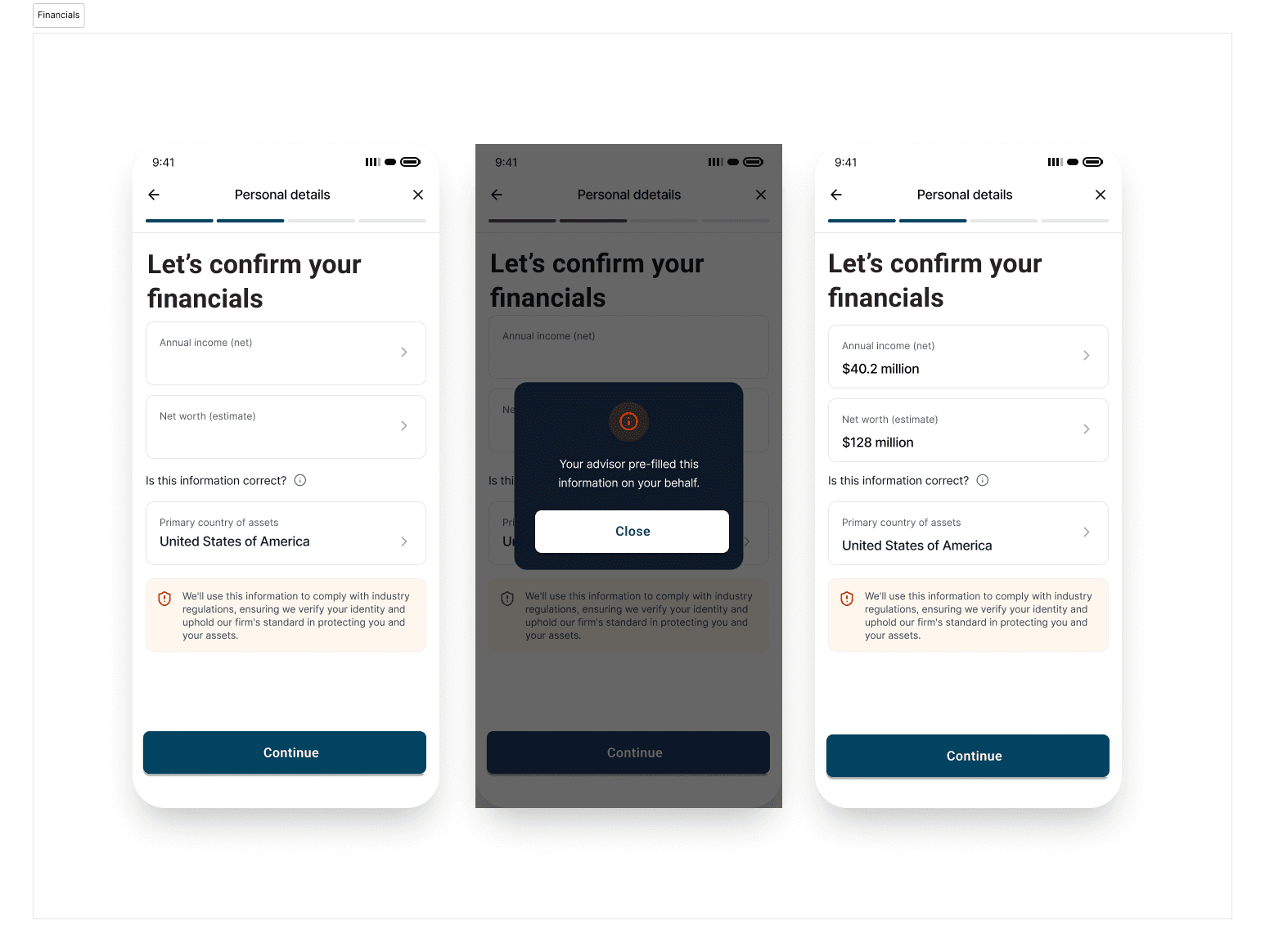

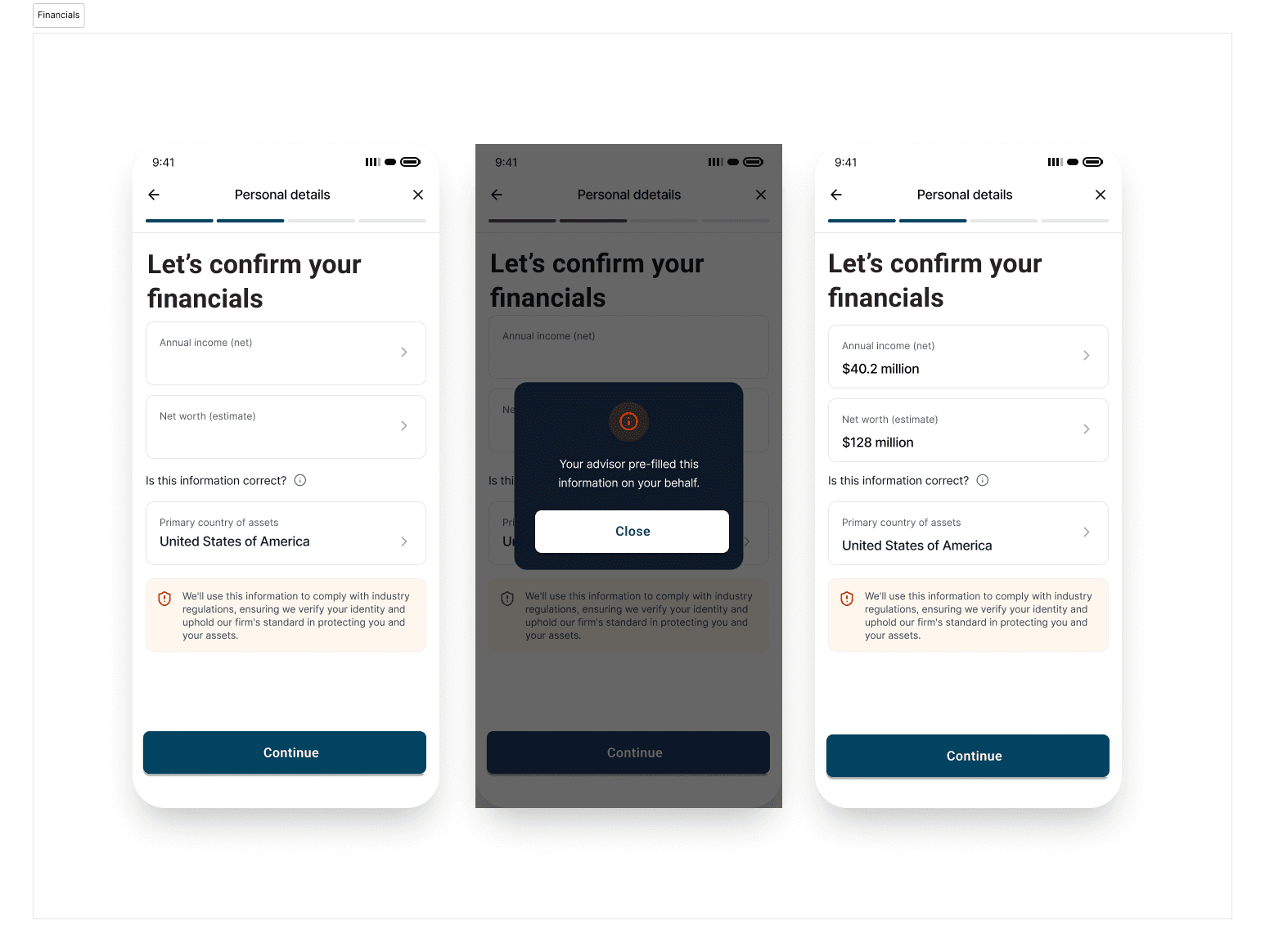

Enabling seamless advisor connection

We continued mirroring the concierge, dialogue between the product and prospects by:

Implementing human touch points within automation: Clearly signposting when advisor involvement is needed while allowing clients to progress independently on straightforward steps

Confirmation over interrogation: Pre-filling verified data where possible, asking "Is this information correct?" rather than requiring clients to re-enter information they'd already shared with their advisor

So far, this approach has reduced back-and-forth between advisors and clients by 40%.

Outcomes

Currently, we're running a pilot MVP. Based on previous usability testing, success metrics include:

Task completion rate - > 95% (on target)

Completion in 1 session - > 85% (on target

Time to complete - < 30 minutes (currently averaging around 6 minutes)

Comprehension accuracy - > 95% (on target - no in-app request for banker support)

STP (straight through processing) and response accuracy - 90% (on target, however also dependent on internal systems)

Alongside this, 100% of our regulatory disclosures have been marked as compliant, recording 0 identified violations (only recommendations).

The current onboarding process for opening a private bank account is cumbersome, repetitive and most-significantly largely offline.

Context

Private bankers build relationships with high and ultra-high-net-worth individuals in premium, offline settings such as exclusive events. However, the experience of onboarding as a private banking client shifts the moment a prospect decides to become a client.

Ideally, the transition to becoming a client should be seamless. However, alongside asking prospects to complete lengthy paper forms, provide the same information (repeatedly) and weeks of back-and-forth to satisfy KYC and AML requirements, the onboarding experience is finalised with bankers asking prospects (many of whom are already digitally savvy) to print, sign, scan and email documents, with inconsistent or non-existent information on why or how their information will be handled.

Onboarding as a private bank client 2 weeks on average, with identity and source of wealth verification alone requiring 3-5 days (and even longer for complex cases). Up to 80% of prospects drop-off and don't complete the process. c

Meanwhile, bankers faced an impossible task of maintaining engagement with prospects and keeping them "warm" with limited official tools to help. The promise of a high-touch, personalised private banking experience that'd convinced some prospects to join disappeared the moment.

Objective

To uplift the onboarding experience, delivering a streamlined digital experience that's personalised and affirms confidence of prospects who've committed to becoming a client of the private bank.

My role and approach

Discovery and audit

Through user research and feedback from recently onboarded clients and advisors, we identified that the current onboarding experience created 3 fundamental problems:

Cognitive overload, particularly for clients new to wealth management

Inefficient and insecure back-and-forth with advisors

Document sharing processes insecure and incompatible within a mobile-first world

Product, content and experience strategy

These findings shaped our priorities, which translated into 3 grounding pillars of the product, content and experience strategy:

Reduce cognitive load

Building and affirming trust

Enable seamless advisor connection

Reduce cognitive load

Where possible, we prioritised opportunities where we could leverage technology to "do the heavy lifting" of completing several forms, ultimately saving time, for both the bank and the prospect.

This included designing intuitive interactions that could be completed almost anywhere. for example, we designed several contextual pre-filling interactions extracting data from reliable sources such as a valid photo ID, proof of residence and details shared by other account owners (new).

Identity verification is inherently stressful - clients are being asked to photograph sensitive documents on their personal devices. We designed this experience to feel guided and secure rather than overwhelming, including:

Clear choice architecture: 3 photo ID options presented upfront with radio buttons

One action per screen: Each step focused on a single task, as opposed to rather than multi-step forms

Proactive guidance: Real-time tips appeared contextually, limiting the need for prospects to send screenshots to their advisors for help

Transparent processing: The loading state showed exactly what was happening with a progress indicator, reducing anxiety during the wait

Built-in error recovery: "This looks correct" confirmation with option to "Retake photo"

To finalise this content approach, I worked closely with our legal team to ensure our intuitive approach remained compliant with our KYC requirements.

Form field reduction: 15 (offline) - > 4 confirmation steps.

Building and affirming trust in prospects

To maintain trust with prospects unfamiliar with wealth management processes, we transformed overwhelming legal documentation into a guided, transparent experience. We designed a progressive flow that:

Confirmed pre-filled information first ("Is this information correct?") - reducing cognitive load and building confidence through accuracy

Explained what they were signing in plain language before presenting documents - "Your account agreements" instead of document reference numbers

Showed transparent previews of dense legal text alongside conversational explanations

Created clear signing touch points with "SIGNATURE REQUIRED" labels that set expectations

Mirrored the concierge style product dialogue with personalised pacing: "John, please take a moment" - addressing the client by name and acknowledging thei important decisions require pause.

This approach maintained full regulatory compliance while reducing the intimidation factor of legal processes. Clients could see exactly what they were agreeing to, when they'd need to take action, and why each step mattered."

We also applied progressive disclosure and confirmation bias principles - showing clients we already knew them (pre-filled data) before asking them to trust us with their wealth (signing agreements). This sequence reduced anxiety and built confidence.

Enabling seamless advisor connection

We continued mirroring the concierge, dialogue between the product and prospects by:

Implementing human touch points within automation: Clearly signposting when advisor involvement is needed while allowing clients to progress independently on straightforward steps

Confirmation over interrogation: Pre-filling verified data where possible, asking "Is this information correct?" rather than requiring clients to re-enter information they'd already shared with their advisor

So far, this approach has reduced back-and-forth between advisors and clients by 40%.

Outcomes

Currently, we're running a pilot MVP. Based on previous usability testing, success metrics include:

Task completion rate - > 95% (on target)

Completion in 1 session - > 85% (on target

Time to complete - < 30 minutes (currently averaging around 6 minutes)

Comprehension accuracy - > 95% (on target - no in-app request for banker support)

STP (straight through processing) and response accuracy - 90% (on target, however also dependent on internal systems)

Alongside this, 100% of our regulatory disclosures have been marked as compliant, recording 0 identified violations (only recommendations).

The current onboarding process for opening a private bank account is cumbersome, repetitive and most-significantly largely offline.

Context

Private bankers build relationships with high and ultra-high-net-worth individuals in premium, offline settings such as exclusive events. However, the experience of onboarding as a private banking client shifts the moment a prospect decides to become a client.

Ideally, the transition to becoming a client should be seamless. However, alongside asking prospects to complete lengthy paper forms, provide the same information (repeatedly) and weeks of back-and-forth to satisfy KYC and AML requirements, the onboarding experience is finalised with bankers asking prospects (many of whom are already digitally savvy) to print, sign, scan and email documents, with inconsistent or non-existent information on why or how their information will be handled.

Onboarding as a private bank client 2 weeks on average, with identity and source of wealth verification alone requiring 3-5 days (and even longer for complex cases). Up to 80% of prospects drop-off and don't complete the process. c

Meanwhile, bankers faced an impossible task of maintaining engagement with prospects and keeping them "warm" with limited official tools to help. The promise of a high-touch, personalised private banking experience that'd convinced some prospects to join disappeared the moment.

Objective

To uplift the onboarding experience, delivering a streamlined digital experience that's personalised and affirms confidence of prospects who've committed to becoming a client of the private bank.

My role and approach

Discovery and audit

Through user research and feedback from recently onboarded clients and advisors, we identified that the current onboarding experience created 3 fundamental problems:

Cognitive overload, particularly for clients new to wealth management

Inefficient and insecure back-and-forth with advisors

Document sharing processes insecure and incompatible within a mobile-first world

Product, content and experience strategy

These findings shaped our priorities, which translated into 3 grounding pillars of the product, content and experience strategy:

Reduce cognitive load

Building and affirming trust

Enable seamless advisor connection

Reduce cognitive load

Where possible, we prioritised opportunities where we could leverage technology to "do the heavy lifting" of completing several forms, ultimately saving time, for both the bank and the prospect.

This included designing intuitive interactions that could be completed almost anywhere. for example, we designed several contextual pre-filling interactions extracting data from reliable sources such as a valid photo ID, proof of residence and details shared by other account owners (new).

Identity verification is inherently stressful - clients are being asked to photograph sensitive documents on their personal devices. We designed this experience to feel guided and secure rather than overwhelming, including:

Clear choice architecture: 3 photo ID options presented upfront with radio buttons

One action per screen: Each step focused on a single task, as opposed to rather than multi-step forms

Proactive guidance: Real-time tips appeared contextually, limiting the need for prospects to send screenshots to their advisors for help

Transparent processing: The loading state showed exactly what was happening with a progress indicator, reducing anxiety during the wait

Built-in error recovery: "This looks correct" confirmation with option to "Retake photo"

To finalise this content approach, I worked closely with our legal team to ensure our intuitive approach remained compliant with our KYC requirements.

Form field reduction: 15 (offline) - > 4 confirmation steps.

Building and affirming trust in prospects

To maintain trust with prospects unfamiliar with wealth management processes, we transformed overwhelming legal documentation into a guided, transparent experience. We designed a progressive flow that:

Confirmed pre-filled information first ("Is this information correct?") - reducing cognitive load and building confidence through accuracy

Explained what they were signing in plain language before presenting documents - "Your account agreements" instead of document reference numbers

Showed transparent previews of dense legal text alongside conversational explanations

Created clear signing touch points with "SIGNATURE REQUIRED" labels that set expectations

Mirrored the concierge style product dialogue with personalised pacing: "John, please take a moment" - addressing the client by name and acknowledging thei important decisions require pause.

This approach maintained full regulatory compliance while reducing the intimidation factor of legal processes. Clients could see exactly what they were agreeing to, when they'd need to take action, and why each step mattered."

We also applied progressive disclosure and confirmation bias principles - showing clients we already knew them (pre-filled data) before asking them to trust us with their wealth (signing agreements). This sequence reduced anxiety and built confidence.

Enabling seamless advisor connection

We continued mirroring the concierge, dialogue between the product and prospects by:

Implementing human touch points within automation: Clearly signposting when advisor involvement is needed while allowing clients to progress independently on straightforward steps

Confirmation over interrogation: Pre-filling verified data where possible, asking "Is this information correct?" rather than requiring clients to re-enter information they'd already shared with their advisor

So far, this approach has reduced back-and-forth between advisors and clients by 40%.

Outcomes

Currently, we're running a pilot MVP. Based on previous usability testing, success metrics include:

Task completion rate - > 95% (on target)

Completion in 1 session - > 85% (on target

Time to complete - < 30 minutes (currently averaging around 6 minutes)

Comprehension accuracy - > 95% (on target - no in-app request for banker support)

STP (straight through processing) and response accuracy - 90% (on target, however also dependent on internal systems)

Alongside this, 100% of our regulatory disclosures have been marked as compliant, recording 0 identified violations (only recommendations).

Next project

Supporting British traders through Brexit

Objective

To ease and support British businesses through the trading transitions.

To ease and support British businesses through the trading transitions.