Password protected

To comply with NDAs and confidentiality agreements, a password is required to view my previous work.

Email alisha.oni@googlemail.com if you're struggling to access.

Supporting British traders through Brexit

Objective

To ease and support British businesses through the trading transitions.

Objective

To ease and support British businesses through the trading transitions.

Objective

To ease and support British businesses through the trading transitions.

The problem

The UK's departure from the EU created new financial protocols, including tariffs, for importing and exporting goods between the UK and the EU and within the UK (Northern Ireland). Tariffs varied based on the type and size of business and the categorisation of goods. The government had also created waivers and exemptions to mitigate the burden of sudden, additional costs for small- to medium-businesses (traders).

In February 2021 (after Brexit), HMRC were experiencing an increasing number of enquiries and complaints relating to post-Brexit trade, with call data indicating up to a 33% increase in comparison to the previous year. It became increasingly apparent that traders were struggling to locate and understand information about these changes.

“As an English medium-sized business, I need to understand what tariffs apply to me, so I can account for additional costs and understand if I’m eligible for a waiver.”

Team and tasks

An increasing number of impacted businesses publicly voiced their frustration, attracting media attention. The problem rapidly escalated, becoming an urgent priority due to the risk of losing billions in trade revenue and damaging the government's reputation. We received an urgent ministerial request to create a solution.

2 Content designers (including me)

4 Subject matter experts (SMEs)

2 User researchers

Discovery and findings

Some actions in discovery included:

Auditing existing guidance and content

Reviewing page feedback and comments

Consulting with stakeholders within HMRC

Findings within existing guidance

Structure

Lengthy web documents (not web pages)

Focused on policy, not trader (user) needs

Chapters weren’t based on actions users should take

Tough to find essential info such as "criteria" (even with ctrl + F)

No implicit or explicit call-to-action

Instructions weren’t broken down into steps, buried in parahraphs

Language

Guidance included many technical terms, increasing the reading age of information

Example: interchangeable use of “charges” “duties”

This risked confusing traders with lower subject knowledge and/or literacy levels.

Frequently searched terms

Google Trends and searches within GOV.UK highlighted popular related terms, including:

“tariffs”

“deadline”

“duties”

“exemptions”

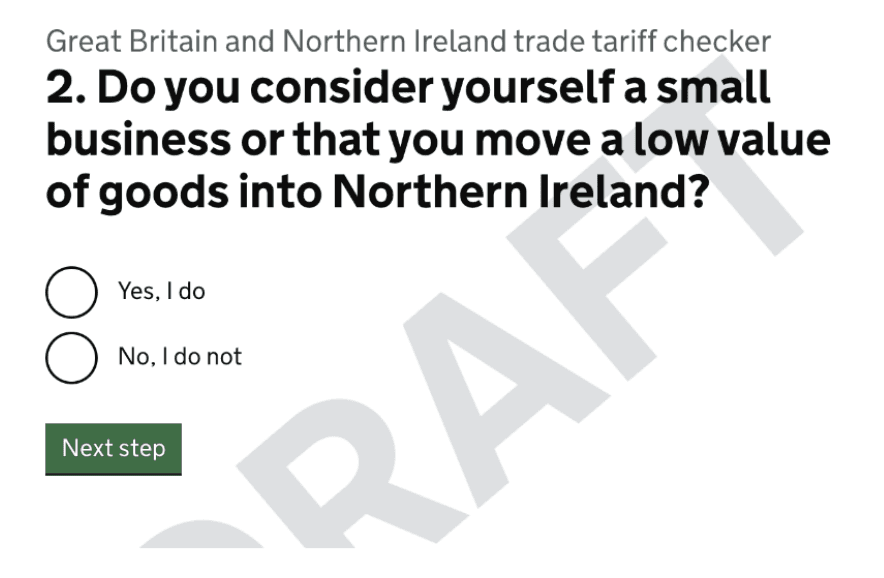

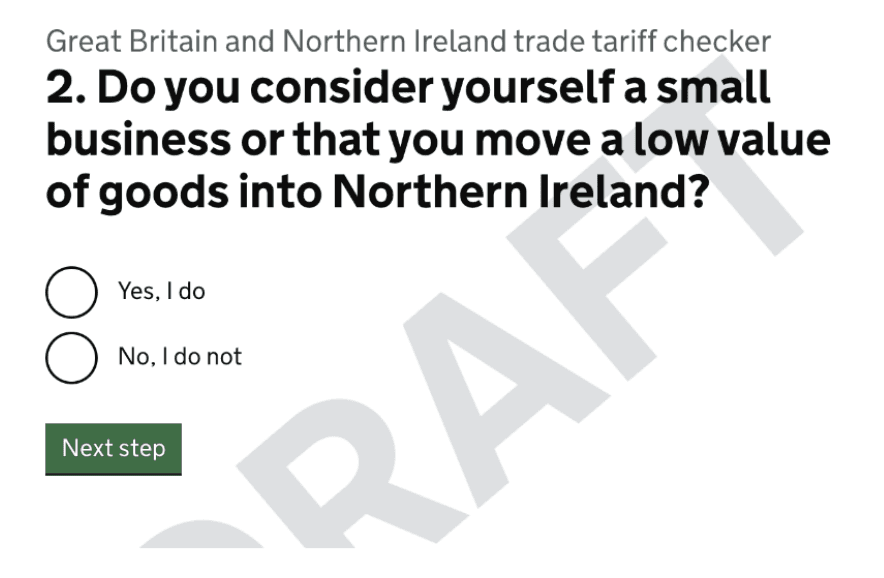

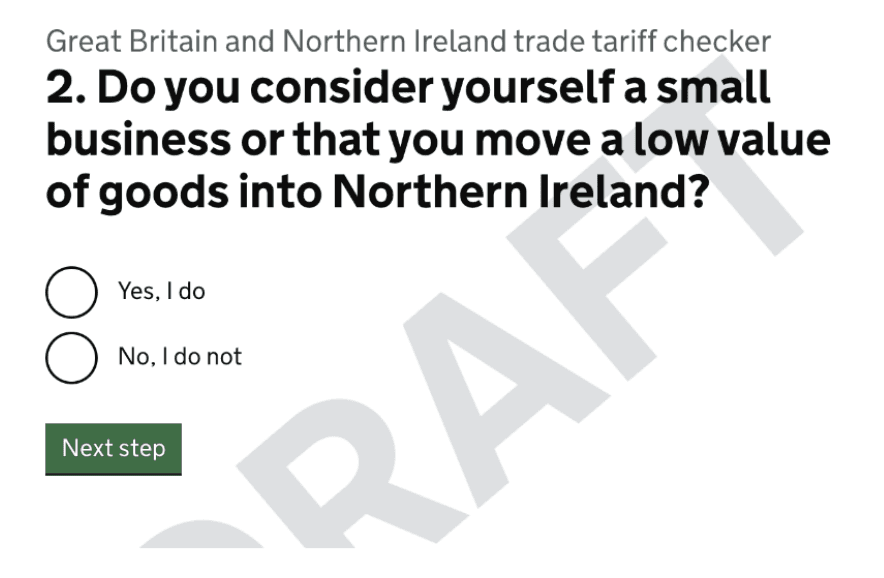

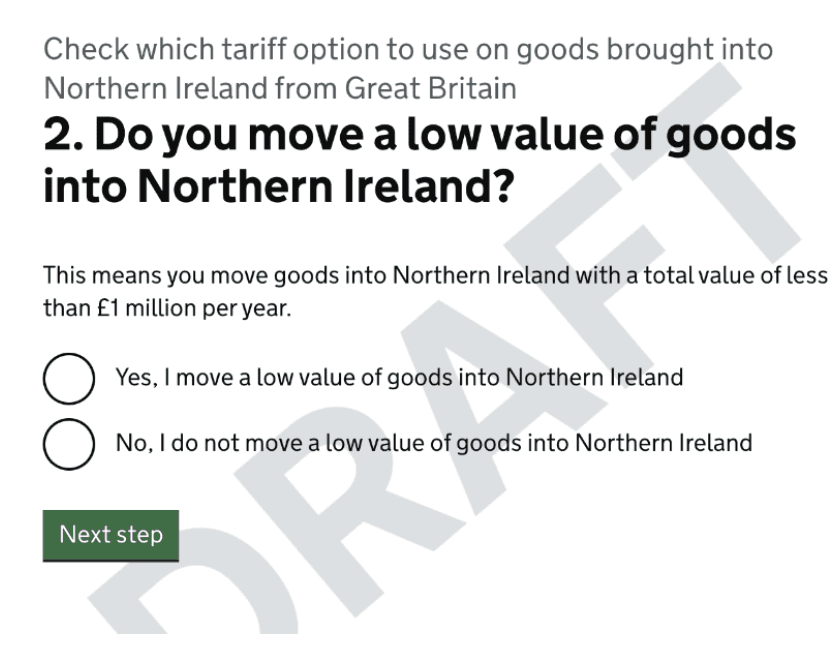

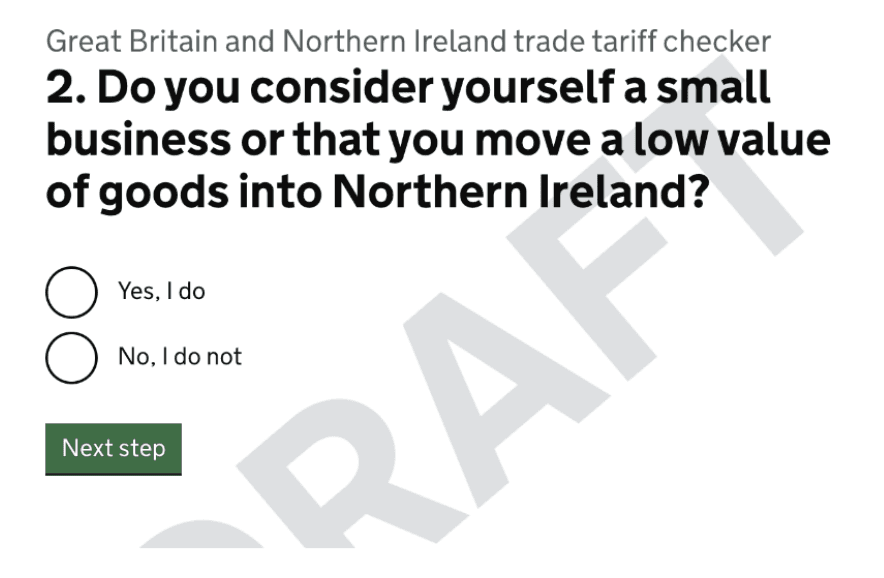

Before | After |

|---|---|

|  |

Response to testing

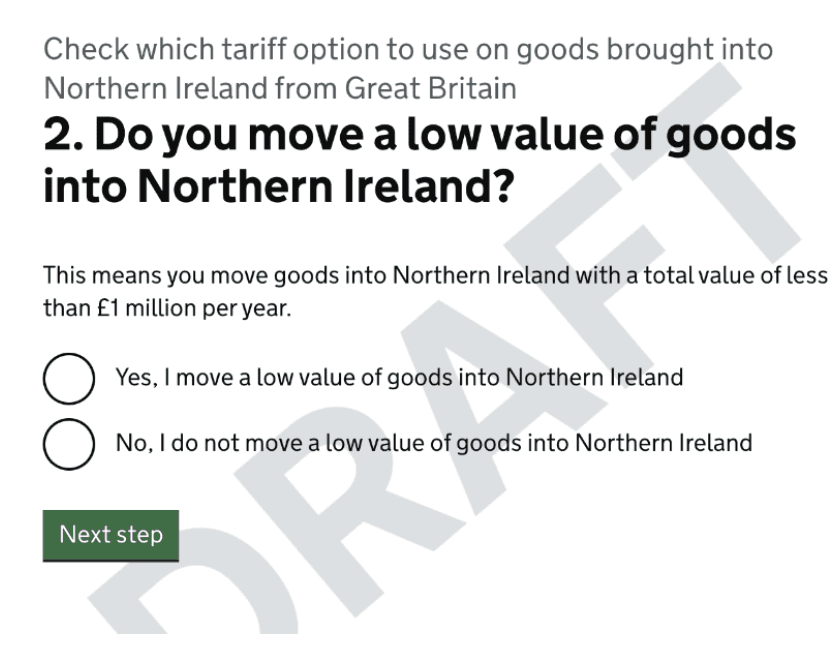

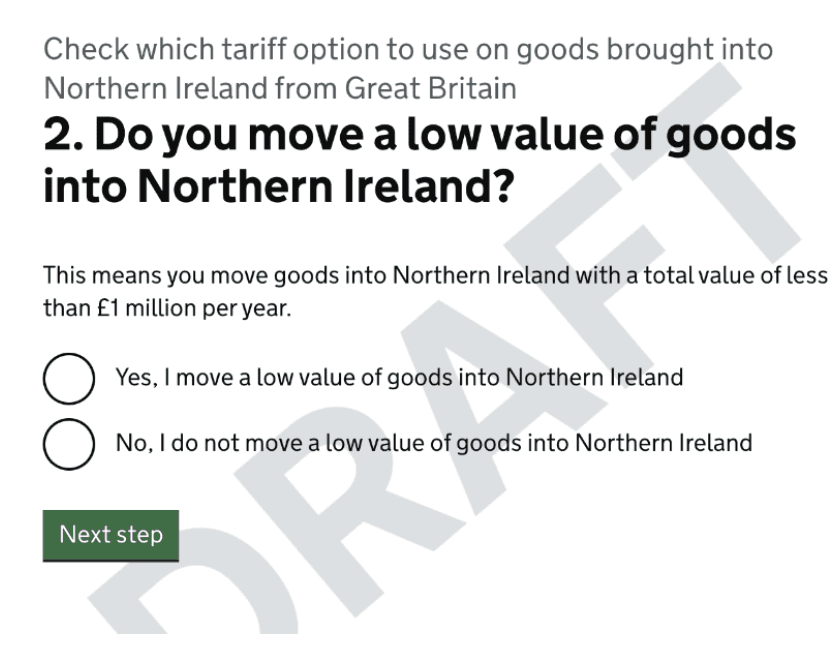

I recommended separating the question as criteria relating to “low value” and “small business” weren’t interdependent (the outcome depended on traders answering “yes” or “no” to one, not both or neither).

To maximise clarity within the question, I also included:

An objective definition of “low value”

Affirming statements alongside radio buttons to maximise confidence

I also changed the focus of the tool's title, focusing on the user goal rather than a description of the tool.

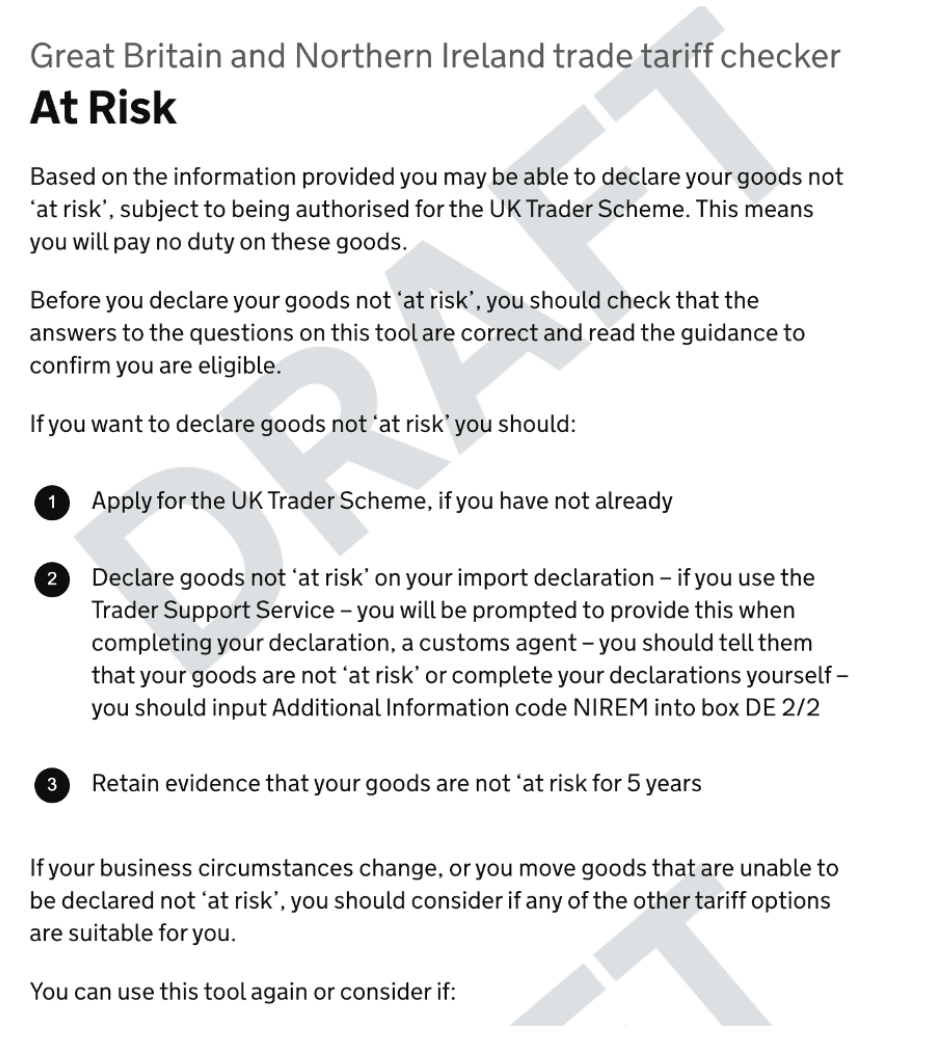

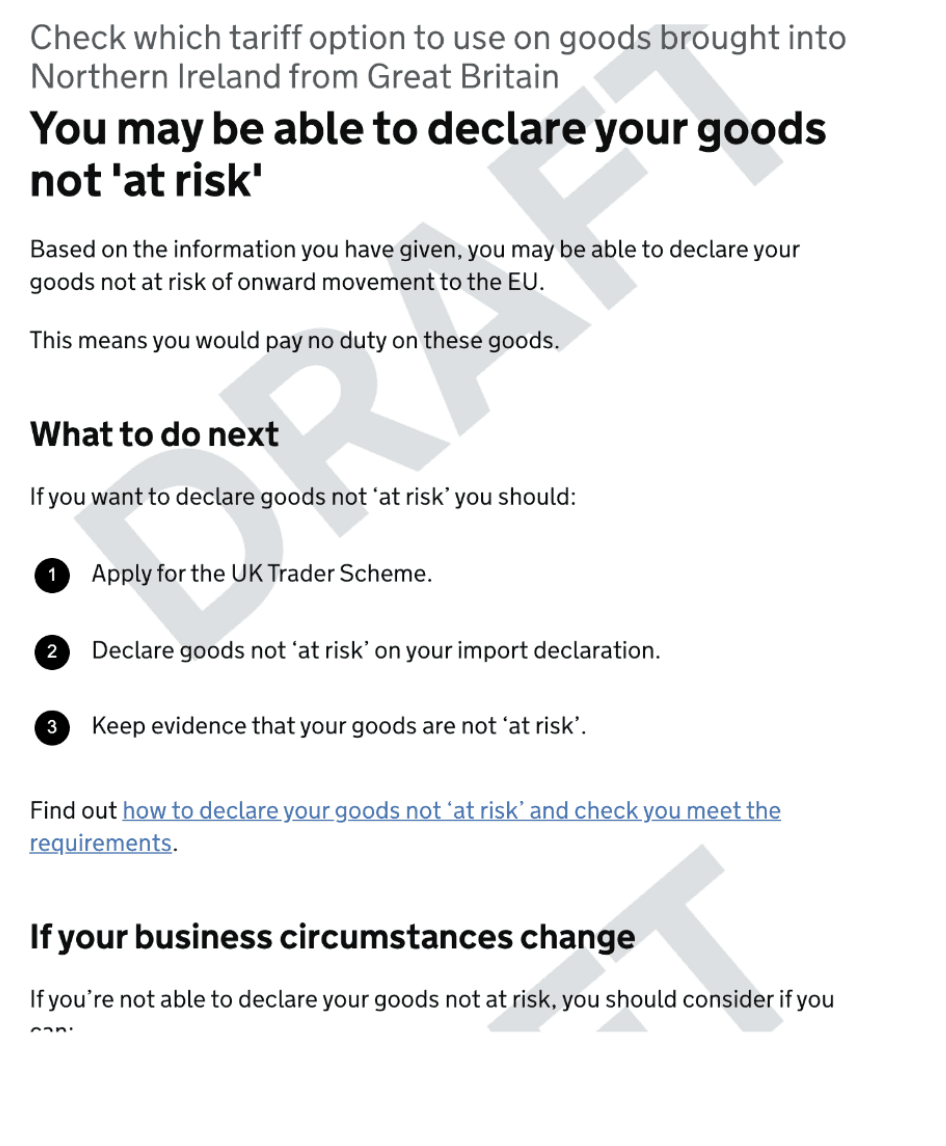

Before | After |

|---|---|

|  |

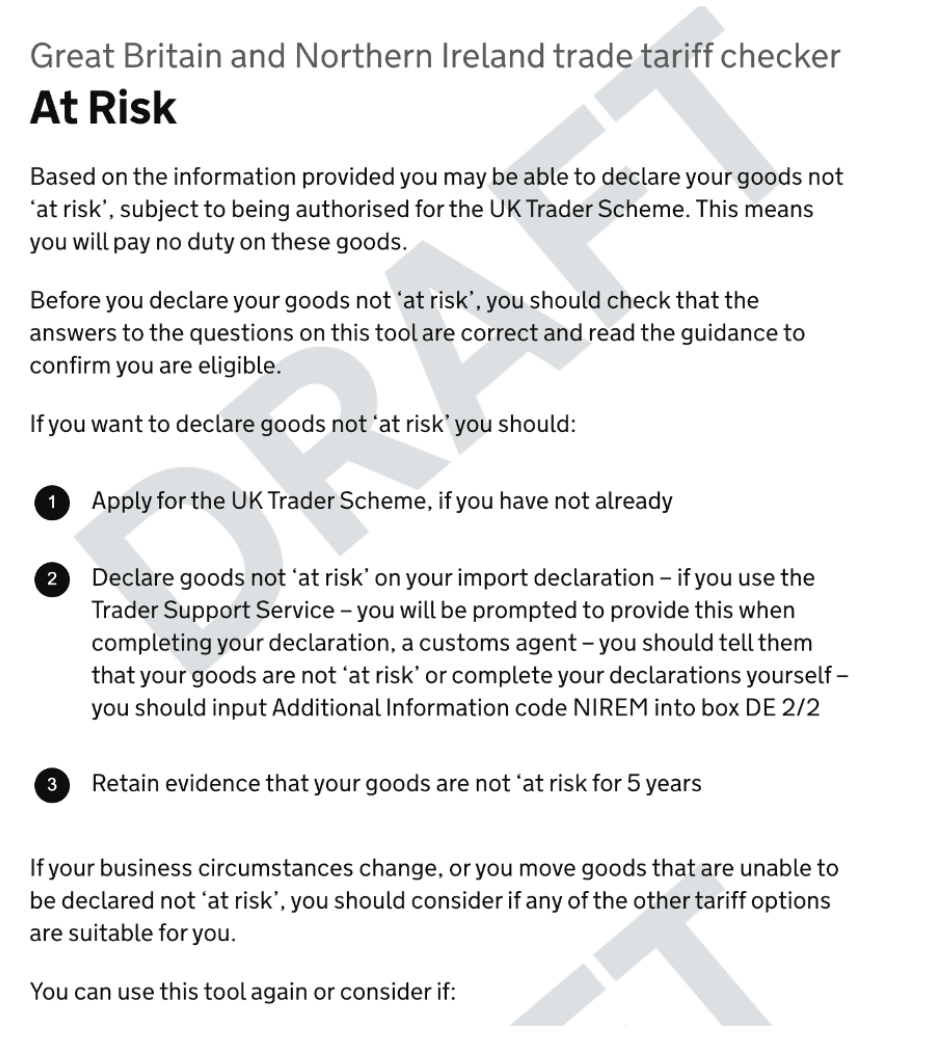

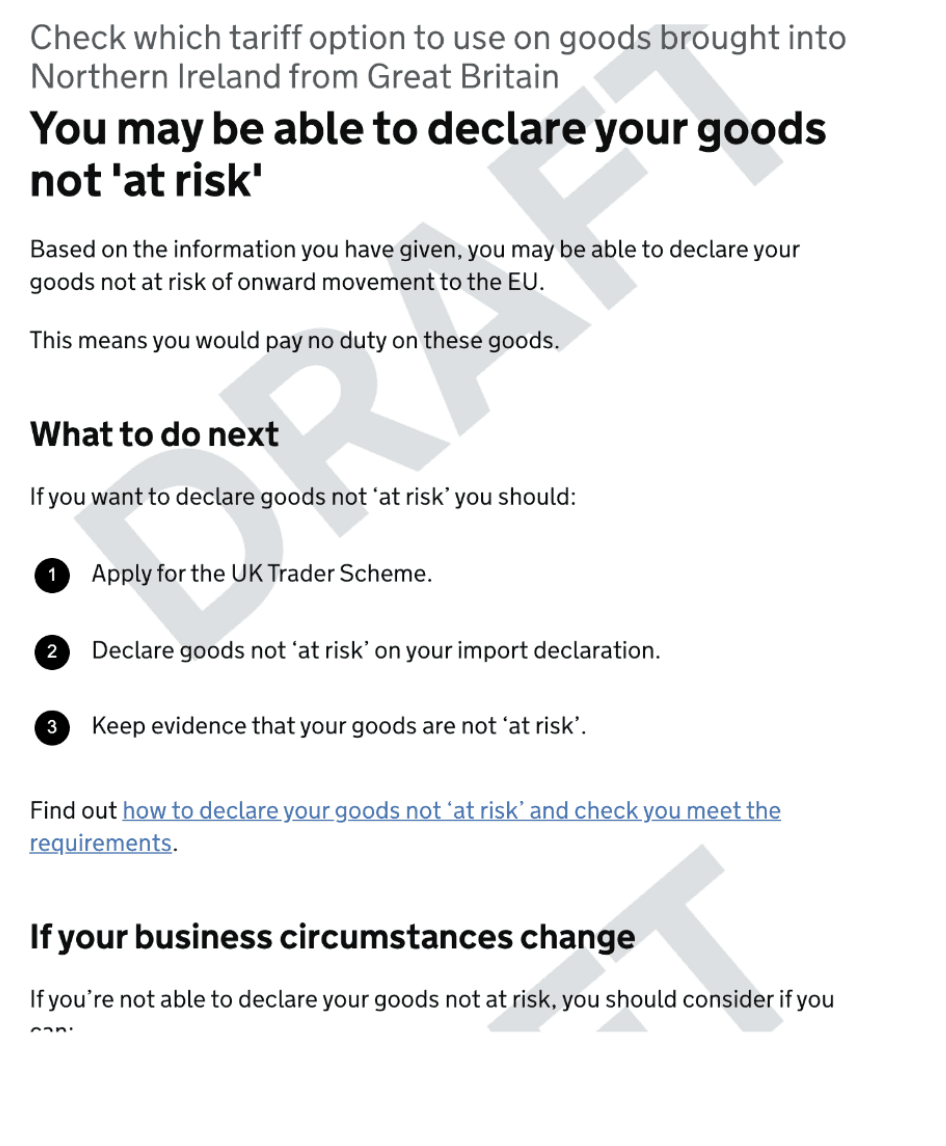

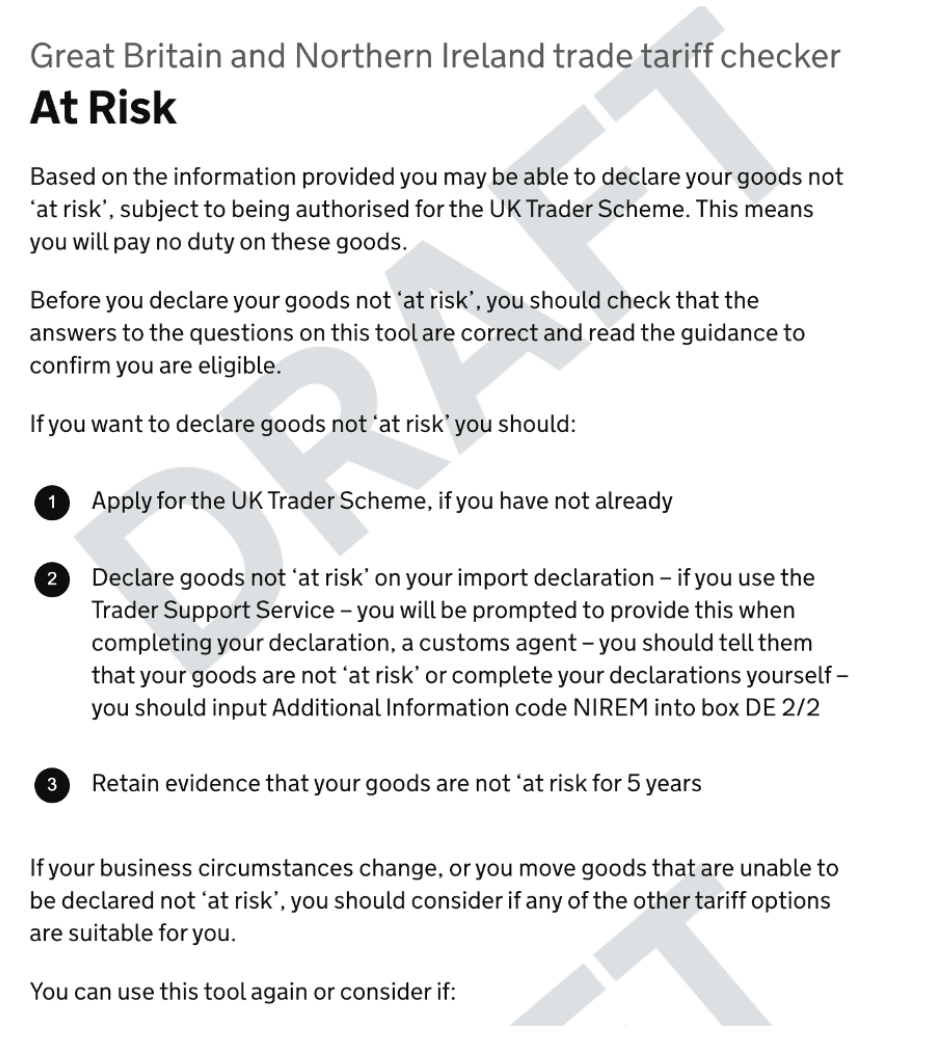

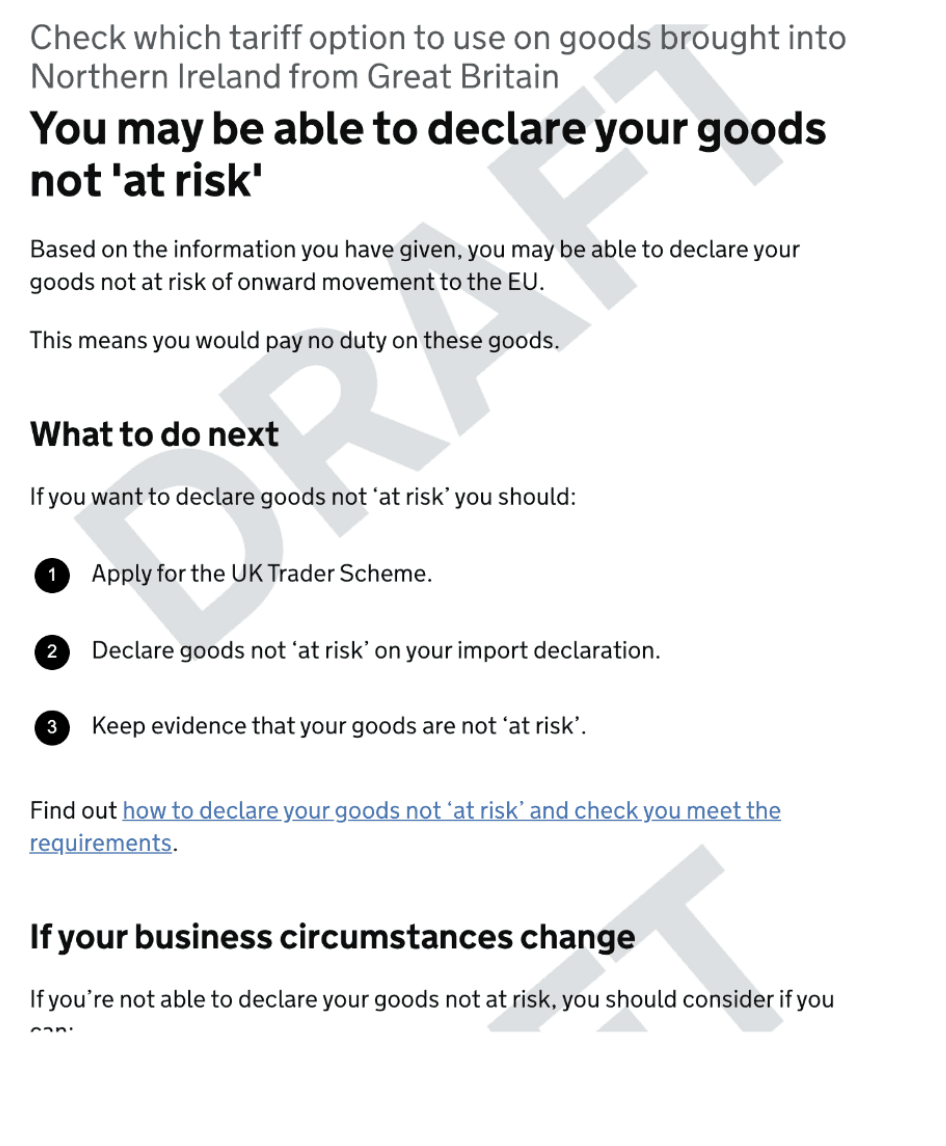

Main changes

I reordered this information, prioritising:

What option HMRC recommended to traders

How to access that option

Where to get additional support

To maintain accuracy and align with HMRC’s policy, we had to retain the phrase “at risk”. However, to improve comprehension, I redrafted the title changed a clear statement.

I also added a clear, recommendation to traders via the header “What to do next”.

The problem

The UK's departure from the EU created new financial protocols, including tariffs, for importing and exporting goods between the UK and the EU and within the UK (Northern Ireland). Tariffs varied based on the type and size of business and the categorisation of goods. The government had also created waivers and exemptions to mitigate the burden of sudden, additional costs for small- to medium-businesses (traders).

In February 2021 (after Brexit), HMRC were experiencing an increasing number of enquiries and complaints relating to post-Brexit trade, with call data indicating up to a 33% increase in comparison to the previous year. It became increasingly apparent that traders were struggling to locate and understand information about these changes.

“As an English medium-sized business, I need to understand what tariffs apply to me, so I can account for additional costs and understand if I’m eligible for a waiver.”

Team and tasks

An increasing number of impacted businesses publicly voiced their frustration, attracting media attention. The problem rapidly escalated, becoming an urgent priority due to the risk of losing billions in trade revenue and damaging the government's reputation. We received an urgent ministerial request to create a solution.

2 Content designers (including me)

4 Subject matter experts (SMEs)

2 User researchers

Discovery and findings

Some actions in discovery included:

Auditing existing guidance and content

Reviewing page feedback and comments

Consulting with stakeholders within HMRC

Findings within existing guidance

Structure

Lengthy web documents (not web pages)

Focused on policy, not trader (user) needs

Chapters weren’t based on actions users should take

Tough to find essential info such as "criteria" (even with ctrl + F)

No implicit or explicit call-to-action

Instructions weren’t broken down into steps, buried in parahraphs

Language

Guidance included many technical terms, increasing the reading age of information

Example: interchangeable use of “charges” “duties”

This risked confusing traders with lower subject knowledge and/or literacy levels.

Frequently searched terms

Google Trends and searches within GOV.UK highlighted popular related terms, including:

“tariffs”

“deadline”

“duties”

“exemptions”

Before | After |

|---|---|

|  |

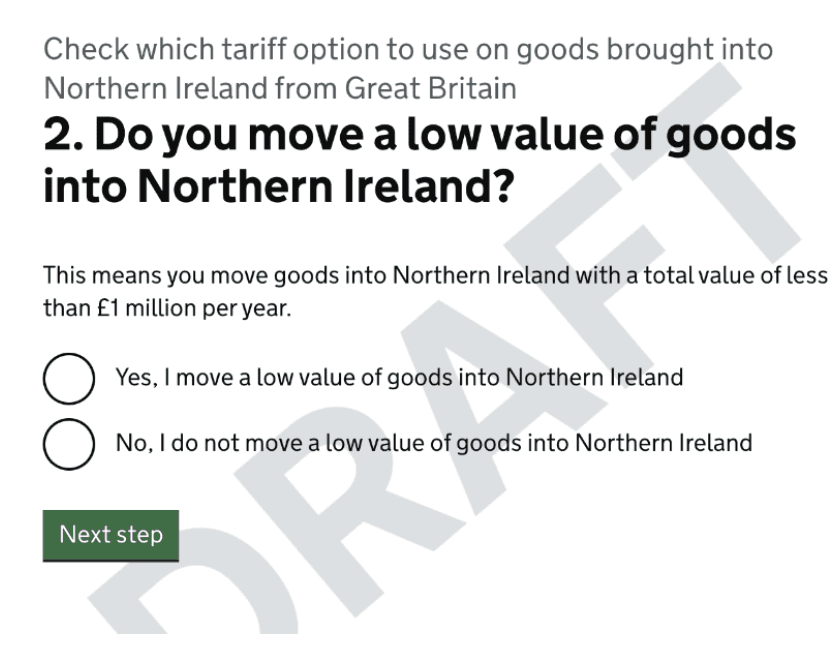

Response to testing

I recommended separating the question as criteria relating to “low value” and “small business” weren’t interdependent (the outcome depended on traders answering “yes” or “no” to one, not both or neither).

To maximise clarity within the question, I also included:

An objective definition of “low value”

Affirming statements alongside radio buttons to maximise confidence

I also changed the focus of the tool's title, focusing on the user goal rather than a description of the tool.

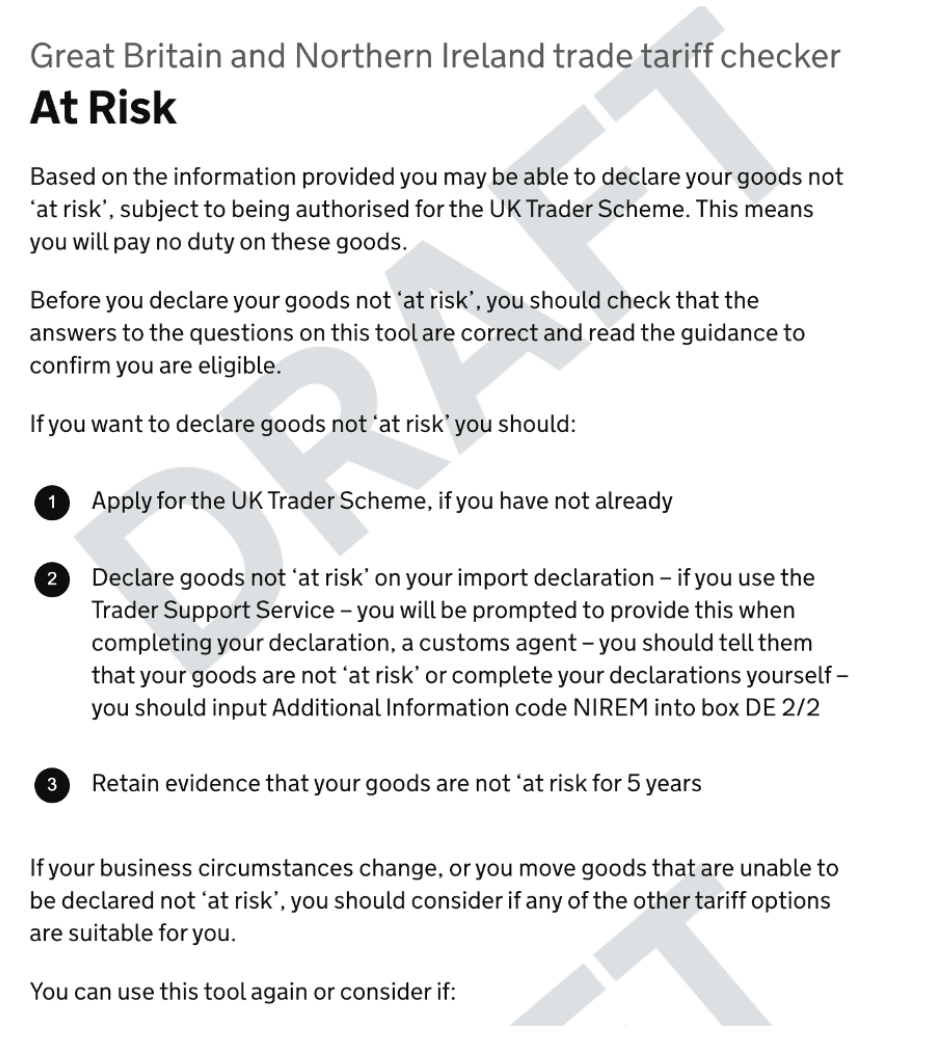

Before | After |

|---|---|

|  |

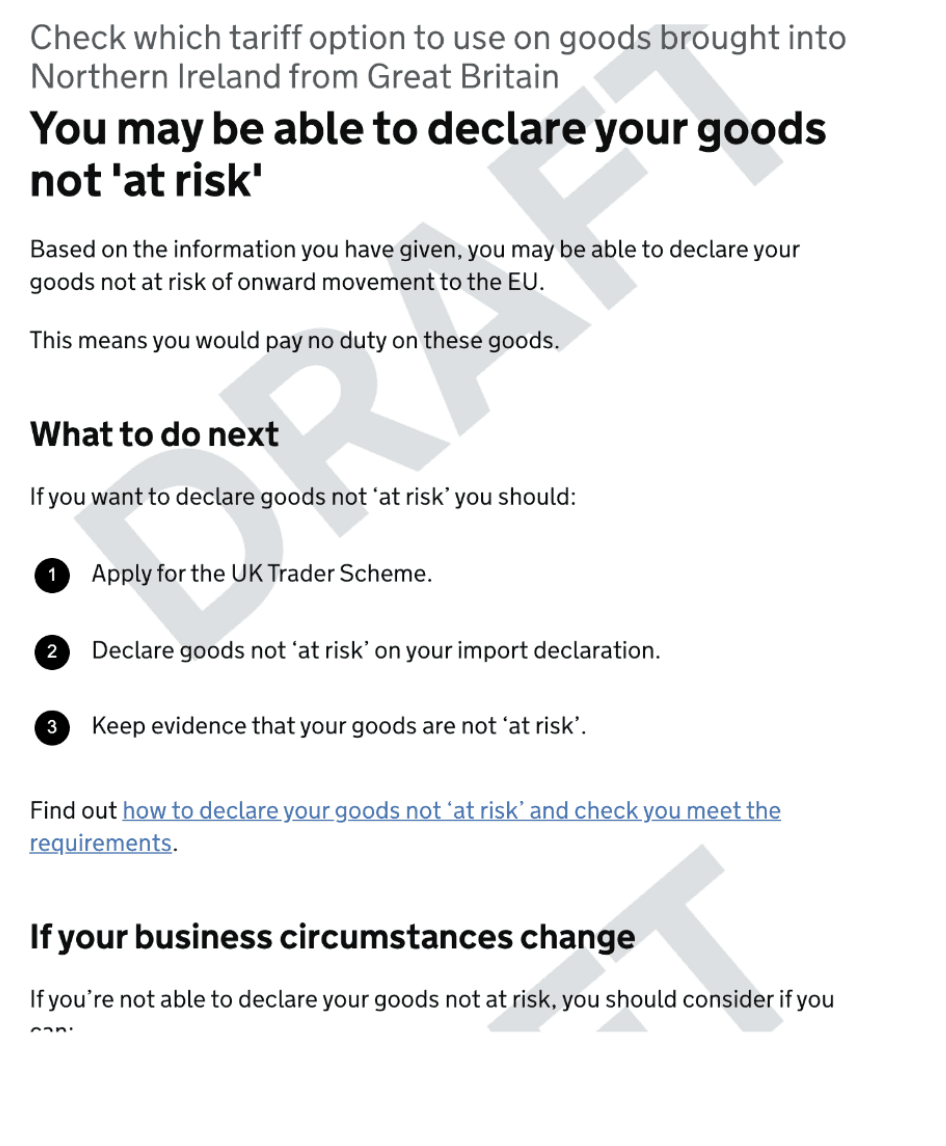

Main changes

I reordered this information, prioritising:

What option HMRC recommended to traders

How to access that option

Where to get additional support

To maintain accuracy and align with HMRC’s policy, we had to retain the phrase “at risk”. However, to improve comprehension, I redrafted the title changed a clear statement.

I also added a clear, recommendation to traders via the header “What to do next”.

The problem

The UK's departure from the EU created new financial protocols, including tariffs, for importing and exporting goods between the UK and the EU and within the UK (Northern Ireland). Tariffs varied based on the type and size of business and the categorisation of goods. The government had also created waivers and exemptions to mitigate the burden of sudden, additional costs for small- to medium-businesses (traders).

In February 2021 (after Brexit), HMRC were experiencing an increasing number of enquiries and complaints relating to post-Brexit trade, with call data indicating up to a 33% increase in comparison to the previous year. It became increasingly apparent that traders were struggling to locate and understand information about these changes.

“As an English medium-sized business, I need to understand what tariffs apply to me, so I can account for additional costs and understand if I’m eligible for a waiver.”

Team and tasks

An increasing number of impacted businesses publicly voiced their frustration, attracting media attention. The problem rapidly escalated, becoming an urgent priority due to the risk of losing billions in trade revenue and damaging the government's reputation. We received an urgent ministerial request to create a solution.

2 Content designers (including me)

4 Subject matter experts (SMEs)

2 User researchers

Discovery and findings

Some actions in discovery included:

Auditing existing guidance and content

Reviewing page feedback and comments

Consulting with stakeholders within HMRC

Findings within existing guidance

Structure

Lengthy web documents (not web pages)

Focused on policy, not trader (user) needs

Chapters weren’t based on actions users should take

Tough to find essential info such as "criteria" (even with ctrl + F)

No implicit or explicit call-to-action

Instructions weren’t broken down into steps, buried in parahraphs

Language

Guidance included many technical terms, increasing the reading age of information

Example: interchangeable use of “charges” “duties”

This risked confusing traders with lower subject knowledge and/or literacy levels.

Frequently searched terms

Google Trends and searches within GOV.UK highlighted popular related terms, including:

“tariffs”

“deadline”

“duties”

“exemptions”

Before | After |

|---|---|

|  |

Response to testing

I recommended separating the question as criteria relating to “low value” and “small business” weren’t interdependent (the outcome depended on traders answering “yes” or “no” to one, not both or neither).

To maximise clarity within the question, I also included:

An objective definition of “low value”

Affirming statements alongside radio buttons to maximise confidence

I also changed the focus of the tool's title, focusing on the user goal rather than a description of the tool.

Before | After |

|---|---|

|  |

Main changes

I reordered this information, prioritising:

What option HMRC recommended to traders

How to access that option

Where to get additional support

To maintain accuracy and align with HMRC’s policy, we had to retain the phrase “at risk”. However, to improve comprehension, I redrafted the title changed a clear statement.

I also added a clear, recommendation to traders via the header “What to do next”.

The problem

The UK's departure from the EU created new financial protocols, including tariffs, for importing and exporting goods between the UK and the EU and within the UK (Northern Ireland). Tariffs varied based on the type and size of business and the categorisation of goods. The government had also created waivers and exemptions to mitigate the burden of sudden, additional costs for small- to medium-businesses (traders).

In February 2021 (after Brexit), HMRC were experiencing an increasing number of enquiries and complaints relating to post-Brexit trade, with call data indicating up to a 33% increase in comparison to the previous year. It became increasingly apparent that traders were struggling to locate and understand information about these changes.

“As an English medium-sized business, I need to understand what tariffs apply to me, so I can account for additional costs and understand if I’m eligible for a waiver.”

Team and tasks

An increasing number of impacted businesses publicly voiced their frustration, attracting media attention. The problem rapidly escalated, becoming an urgent priority due to the risk of losing billions in trade revenue and damaging the government's reputation. We received an urgent ministerial request to create a solution.

2 Content designers (including me)

4 Subject matter experts (SMEs)

2 User researchers

Discovery and findings

Some actions in discovery included:

Auditing existing guidance and content

Reviewing page feedback and comments

Consulting with stakeholders within HMRC

Findings within existing guidance

Structure

Lengthy web documents (not web pages)

Focused on policy, not trader (user) needs

Chapters weren’t based on actions users should take

Tough to find essential info such as "criteria" (even with ctrl + F)

No implicit or explicit call-to-action

Instructions weren’t broken down into steps, buried in parahraphs

Language

Guidance included many technical terms, increasing the reading age of information

Example: interchangeable use of “charges” “duties”

This risked confusing traders with lower subject knowledge and/or literacy levels.

Frequently searched terms

Google Trends and searches within GOV.UK highlighted popular related terms, including:

“tariffs”

“deadline”

“duties”

“exemptions”

Before | After |

|---|---|

|  |

Response to testing

I recommended separating the question as criteria relating to “low value” and “small business” weren’t interdependent (the outcome depended on traders answering “yes” or “no” to one, not both or neither).

To maximise clarity within the question, I also included:

An objective definition of “low value”

Affirming statements alongside radio buttons to maximise confidence

I also changed the focus of the tool's title, focusing on the user goal rather than a description of the tool.

Before | After |

|---|---|

|  |

Main changes

I reordered this information, prioritising:

What option HMRC recommended to traders

How to access that option

Where to get additional support

To maintain accuracy and align with HMRC’s policy, we had to retain the phrase “at risk”. However, to improve comprehension, I redrafted the title changed a clear statement.

I also added a clear, recommendation to traders via the header “What to do next”.